Listen:

The West’s misconceptions about Africa are vast, particularly when it comes to the realm of business. Today we are joined by Dr. Deanne de Vries, who has worked across the continent in various capacities for over 30 years. She is currently an advisor for firms looking to enter the African market and is the author of Africa: Open for Business. In this episode, Deanne fills us in on the challenges and the exciting opportunities for doing business in Africa, sharing insights into the evolving tech and startup scenes. We discuss Africa’s agricultural and manufacturing sectors, and Deanne breaks down what governments need to do to boost these industries. To hear about the community-centric focus of African business and to find out why on-the-ground integrated local presence is far more valuable than any data, tune in!

Key Points From This Episode:

- The history of Deanne de Vries’ work in Africa.

- The ABC of learning to do business in unfamiliar territory: Appetite, Bandwidth, and C

- The evolution of the African tech scene.

- The focus of Africa’s startup scene.

- The potential for French-speaking West Africa to rise in the tech sector.

- What governments can do to boost agricultural productivity in Africa.

- The importance of access to the market, in terms of agriculture.

- The challenges faced by Africa’s manufacturing industry.

- Why African business can’t be judged by statistics alone.

- The number one key to success for doing business in Africa.

- Deanne shares a case study to illustrate the importance of being on the ground.

- The potential of the African Continental Free Trade Area to promote business in Africa.

- The greatest Western misunderstandings about doing business in Africa.

- The challenge of data accuracy across Africa.

- What trumps data when it comes to doing business.

- The number one way to de-risk any deal in Africa.

- Deanne shares her chocolate chip cookie story.

- The impact of China’s increasing presence across the continent.

- The influence of Turkey, Russia, and the UAE on Africa.

- How best to think about market entry in Africa.

Transcript:

Kurtis: Welcome to the Charter Cities Podcast. I’m Kurtis Lockhart. On each episode, we invite a leading expert to discuss key trends in global development in the world of cities, including the role of charter cities and innovative governance will play in humanity’s new urban age.

For more information, please follow us on social media, or visit chartercitiesinstitute.org.

Jeffrey: I’m Jeffrey Mason, research manager at the Charter Cities Institute. Joining me on the podcast today is Dr. Deanne de Vries. Deanne has worked in various capacities across Africa for over 30 years. She now advises firms looking to enter the African market and is the author of Africa: Open for Business. We discussed both the challenges and exciting opportunities for doing business in Africa. And in particular, the importance of an on-the-ground integrated local presence. I hope you enjoy our conversation. Thank you for listening.

Jeffrey: Welcome to the show, Deanne. It’s great to have you.

Deanne: Thank you, Jeff. It’s fabulous to be here.

Jeffrey: So in some shape or form, you’ve been working in Africa for over 30 years now. Can you trace that history of your work and how you came to be focused on the continent?

Deanne: Yeah, I’d love to. It actually started when I was six years old, and I heard about how challenging it was for students, or actually, for young people, for children to go to school in Africa. I was surprised that they didn’t have libraries because that’s what I did. Every Saturday, my parents would take us to the library. So when I was six years old, I told my parents that one day I was moving to Africa, and I was going to teach kids how to read and write because everybody should have access to books. Then of course, you simply forget that because there’s so many things you dream about doing as a child. Then, 18 years later, I actually had an opportunity to move to Nairobi as a volunteer and do exactly that. Do literacy training, as well as working as a mentor to women, and helping them start and grow their businesses. As they say, once Africa gets under your skin, you just don’t want to leave. From that, I worked with the UN, I’ve worked with some venture capital companies, started my own company, and now work with companies that want to go to Africa and expand and grow, and basically tap into the wonderful opportunities that Africa provides for business today.

Jeffrey: Obviously, you’ve been on the ground throughout Africa for a while now, and you’ve kind of had to learn firsthand what it’s like to do business in a place that’s different from your original home. What would you say are sort of the mechanics by which either someone or even sort of at the firm level successfully learns to do business in a place that sort of has different conditions on the ground, maybe different norms, different ways of doing things? How was that learned?

Deanne: So it’s not too different really than if you want to just go to a different state or the neighboring country, wherever you’ve started your business today. A lot of people think Africa is so far away, and they tend to think that it’s still the, ‘We Are the World’ and ‘Do They Know it’s Christmas’ kind of thing. I like to joke that each of us has moved on from what we looked like in our high school yearbook pictures, thank goodness, and so has Africa. Really, for me, it’s as straightforward as ABC, Appetite, Bandwidth, and Capital. You need to have an appetite to actually get on the ground, spend time on the ground, seeing what’s there, getting to know the people, getting to understand how they might interact with your service or your product. Bandwidth is giving your team the ability to identify those resources, collect the data. It’s not as readily available as the US, but it’s still there, maybe to do product research, to understand the opportunities for market entry. Then, at the end is really when you talk about capital. A lot of people start with capital, but it’s better to end with it. Because if you’ve got the appetite and the bandwidth, then you’ll know how to correctly invest your capital and not just your day-to-day business expenses, but also in things like investing in the community, in training and development, in local infrastructure, and things like that.

Jeffrey: Absolutely. You’ve worked across a lot of different sectors, and in your work, you’ve highlighted three in particular as sort of being the key sectors to watch for the future in Africa. So let’s discuss those. The first being tech. There’s sort of this dual trend occurring in tech in Africa, where on one hand, you’ve got sort of the giants, Twitter, Google, Microsoft, others. They’re really starting to expand their physical and their digital presence on the continent, opening up local offices, data centers, these kinds of things. While at the same time, at the other sort of end of the spectrum, the African startup scene is really blossoming. You’ve got more and more African startups being accepted, for example, into Y Combinator. More are becoming unicorns. These sort of simultaneous trends, they tend to strike me as a complementary, particularly in terms of sort of creating an environment that generates talent and rewards, investments in the right skills. How do you see the African tech scene evolving over the next decade or two? What areas of life and business do you think are most ready for disruption and improvement by tech?

Deanne: Great questions. I love talking about tech in Africa. The fact that the big guys are waking up and showing up or the big gals, let’s not be sexist, that’s actually great. To me, it’s because when they go there, then all of a sudden it’s like, “Wait. What? Africa?” They also have the resources to try some absolutely kind of wacky things. I mean, Google put balloons up in the air to see if that would help with access to the Internet. It ended up not working, but they had the wherewithal and they had the finances to be able to do that, and that’s really good. The second thing that it does is that, for example, last April, five of the big techs announced they were opening offices in Nairobi, and all of them need staff. It used to be, people would work at the UN, or the embassies, because that was like the place to work. It just really opens up the job opportunities, it opens up training and development. But it also opens up the big tech guys to the great talent that Africa has, and how they can Africanize their products and their services. I think it’s a win-win when the big guys are there.

In terms of the startup scene in Africa, it’s super exciting. They’re not out there to build the next TikTok necessarily. They’re out there to change their local communities, the environment within which they work. That could be the teenager who develops an app in rural Tanzania to connect people that offer services as cleaning, to offices and families that are looking for cleaners. It’s the woman in Nigeria who starts a recycling company. For the families that recycle, they get green points. With those green points, they can pay their electricity bills, school fees, and do grocery shopping. I mean, what an amazing way to encourage a recycling effort? At the same way, then she takes that and passes that on to companies so that the products that they make come from recycled goods.

Again, what you see in the Africa tech sector is win, win, win. It’s a win for the person creating it, it’s a win for the community, it’s a win for the people that are using those products. Another example is counterfeit medicine, which you will still see sometimes in Africa. There are multiple apps that you can just hold up the barcode and know whether or not it’s a bonafide or if it’s been tampered with, or if it’s just plain old counterfeit. So there are so many amazing opportunities. Of course, the biggest or probably the best well-known one is M-PESA. I mean, mobile money that was – I think it’s fairly safe to say, kind of created in Africa. I mean, half of the globe’s mobile money accounts like Apple Pay are in Africa. Who needs a credit card? I got a mobile payment on my phone or on my watch, so there’s so much excitement.

I think to your question about an area that’s open for disruption, or maybe for people to pay attention to, would be French-speaking West Africa. Naturally, a lot of the focus in the beginning was Nigeria, Kenya, South Africa, some of the big hubs. Also, in Arab-speaking North Africa, you had some. But French-speaking West Africa, that’s like about 15 countries. It’s interesting because you see tech companies in Lagos now that are expanding to Kinshasa, it’s French-speaking. But in terms of environment and the city, and the urban life, they have so much in common. They’re more like twins than if they were to expand from Lagos to Abuja, or Lagos to maybe Addis Ababa, or to Accra, Ghana. I think French-speaking West Africa is the next one that’s really going to rise up and people are going to start taking note of.

Jeffrey: Yeah, that’s interesting. Where I think we’re kind of seeing a lot of this, it’s being this sort of development of a really rich ecosystem. I think we’re seeing that reflected in the work we’re doing as well as a lot of these new city projects, and different types of zones are focused on creating sort of tech hubs, and creating better environments for people building startups and this kind of thing. It’s interesting to see how this is all sort of maturing in different ways.

Deanne: Exactly.

Jeffrey: A second area that you point to of importance is of course, agriculture, which is a really big part of most African economies. Yet, a huge chunk of this agricultural activity is either for subsistence, or maybe it’s commercial, but it’s on a small scale. Most of it is not particularly productive, or capital intensive, especially compared to elsewhere in the world. And at the same time, there are some of these different sort of climate-related challenges to agriculture, both in Africa and everywhere else, sort of with limited resources available. What do you think are some of the highest impacts, things that governments can do to boost agricultural productivity, and to kind of support the I think more commercialization of agriculture and moving out of a such a heavy share of subsistence?

Deanne: Yeah. It’s interesting, there’s a quote, there’s a stat that a lot of people, including myself use. We talk about how 60% of the world’s arable land is in Africa. That’s true. However, there’s one problem, access. Agriculture to me goes hand in hand with logistics. You have incredible abundance. When I lived in Uganda, the beautiful red soil, you drop a seed and it grows. But is there access to market? Are there roads to get it to market? Are there warehouses that you can store your goods in? Is there a cold chain that can protect your goods before they’re going for export? To me, the agriculture question goes hand in hand with logistics. That also talks to, Africa’s got the largest proportion of landlocked countries as a continent of any continent in the world. So you’ve got border crossings, and all of that comes with duties and tariffs. What government can do is really work through that. The AfCFTA, the African Continental Free Trade Area is a good mechanism to use for that.

I think the second thing that governments can do is really work with their communities on supporting local-based agriculture. So when I lived in Mozambique, they grew rice in northern Mozambique, which was 2, 800 kilometers away from where I was living in Maputo. However, because of the lack of infrastructure, they were importing rice. Now, in Maputo, they had tomatoes, and they have sweet potatoes, and everything. But people still had this idea that they needed rice for their diet, which to me was fascinating because I always associated rice with something in the Asian cultures. It was the cassava and the potatoes, and the sweet potatoes that I thought were more African. So I think that it’s – there’s also something to be said about really promoting the local produce, and seeing what all you can do. I mean, I had a friend of mine who made the most amazing croissants, and she made them from cassava flour, which was completely new to me.

I think the third area is that when we talk about yields, there is a lot that can be done. But I think also respecting the fact that, to what extent do you use fertilizer and the type of fertilizer. There are people that have tried to promote or are promoting GMO, genetically modified products. From what I’ve experienced on the ground, that’s not really very welcome. People are like – we’re not really sure that’s what we want to do. I’d say the final thing is there are certain countries that are buying up large tracts of land and producing, farming them, and then shipping them back out to their countries. This is particularly in the in the Middle East. I always wonder how much that they do actually benefits the local area. I don’t know all the details, but I think that could be something interesting to look in. I think the reason that Africa is so important is a CEO of Walmart was saying that, for Walmart to have food on their shelves, they need a wider diversity of sources. That diversity right now is really looking towards Africa and it’s already being done. I mean, if you go to Johannesburg and you go to O.R. Tambo Airport, around there, there’s an industrial area where fruits and vegetables are literally trucked in from all across southern Africa. They’re clean, they’re washed, and then they’re chopped up. The next morning, you find them in Tescos in the UK, or Carrefour in France, or Albert Hein here in the Netherlands. So some of its already there, which shows that it can be done. Now, it’s a question of just doing it on a much, much larger scale.

Jeffrey: Yeah, absolutely. But it seems like we’re heading in that direction. I think it seems like there’s a growing emphasis on logistics as sort of an important part of infrastructure. So yeah, it seems like a lot of the, I think investment is going to be directed in this way.

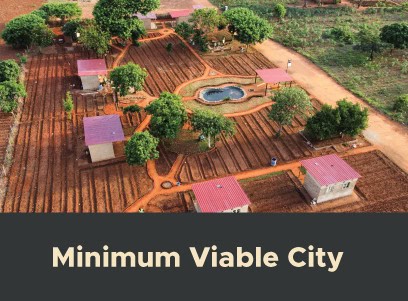

Deanne: That’s a lot of what you’re doing too with the Charter Cities Institute because you’re building cities that take this infrastructure and take the logistics into consideration. These are cities, the current cities are ones that were built back in colonial days. We’re talking 100 years old, 150 years old. The work that you’re doing is so crucial because you’re providing that access, that route to market.

Jeffrey: Thank you. That’s very nice of you. Yeah. That’s what we’re seeing with these projects. So many of them logistics hubs are part of the planning. So I think everyone is cognizant of what needs to be done. The third big area you mentioned and you think is important to focus on is manufacturing, which is in a sense, it’s kind of the big what if for Africa. If I recall correctly, I believe as a share of the economy, manufacturing and Africa essentially peaked in, I believe, the 70s or 80s, and then has declined a bit. The sort of historical case in the West is that improved agricultural productivity produced both the surplus food and the surplus labor to allow for the growth of cities, and labor-intensive manufacturing driving these agglomeration economies, which in turn drove the explosion and prosperity that really took off in the 19th century.

Today, of course, Africa is facing a very different set of circumstances, as we kind of discussed. Agriculture has yet to be transformed to kind of in the same way, the level of state capacity and financial capacity that saw all of the roads, canals, railroads, ports, all of these other pieces of infrastructure built out across entire continents isn’t quite present in Africa. There’s also some interesting work that I’ve seen from some folks at the Center for Global Development and elsewhere, showing that in comparison to potential sort of competitor destinations for manufacturing, like say, Bangladesh. That the sort of prevailing wage level in Africa is, in a lot of cases really too high to be an attractive destination, at least for some types of manufacturing outside of maybe Ethiopia, and a few others. There’s all these sort of compounding issues. What do you think sort of can’t be done and really should be done to make Africa a more attractive manufacturing destination such that these companies are choosing countries in Africa, rather than say Southeast Asia, and also, that you sort of develop a sort of proper domestic African manufacturing sector?

Deanne: Yeah. Great. I think two things to look at when we look at Africa, and we question the level or the lack of manufacturing. Definitely the 19th Century, the US, the UK, a lot of Europeans, manufacturing was a very valid way to measure growth and to propel growth. I don’t believe that that’s still true today. I say that because of the rise of the service industry. The second thing is, oftentimes, countries in Africa get compared to the Asian tigers. There too, that was applicable 30 or 40 years ago, and it’s just discouraging. And yes, I’m a sucker for Africa, but it’s discouraging when people say, “Oh, well. Africa should be mimicking the Asian tigers, and they’re not, so they’re a failure.” It’s like, “Guys, that’s Asia. This is Africa. It is kind of different.” So let’s take a look at not just the makeup and the infrastructure of Africa, but let’s take a look at where the world is today.

I think the manufacturing sector that Africa can and is tapping into is really the whole – what I call the manufacturing without smokestacks. It’s a lot of that service industry. It is the logistics. Because the truth of the matter is, the reason that the wages are higher, is because of the transportation costs. That’s really what ends up making your product so much more expensive, is because you’ve got to pay for that cost, not necessarily to the port of Mombasa. But if you’re moving it inland, that’s where so much of the cost incurs. That’s what makes manufacturing in Africa expensive. Again, it goes back to logistics. You also have the service industries of hospitality, of retail, of technology. I think that Africa would really benefit from focusing on that, and for governments really to create a business-friendly type of industry environment, so that it’s easy for companies to set up, and it’s easy for local companies that are currently operating in the informal market to move into the formal market. I think that if governments can create that business-friendly ecosystem, that you will see a lot more local manufacturing.

I think a final note on that is, there are opportunities, for example, if we just look at what we’ve been through in the past years with COVID and manufacturing vaccines. They can be manufactured on the continent. The question is, will the global companies make the investment and transfer the skills, the knowledge, and also have the trust that that can be done locally?

Jeffrey: Yeah, absolutely. I think it seems like things are moving in the right direction. In a sense, it’s unfortunate that something like COVID maybe is what spurs greater investment in sort of the capacity to produce vaccines and that kind of thing in the continent. But hopefully, I think that’s something that can sort of get the ball rolling on these types of industries. Once they get started, that it can sort of domino from there.

Deanne: Yeah. One thing you mentioned, talking about sort of the ease of doing business, and of course, as many of our listeners will probably know, the Rural Bank, of course, recently stopped with their doing business project. I believe some kind of replacement is in the works. I don’t think there’s too many details on that yet. But I’m sort of curious from your experience, how reflective of conditions on the ground that your firm has actually experienced do you think? That survey or similar surveys actually are – of course, there’s things to be nitpick, but are they broadly, you think representative.

Deanne: I think that they’ve always provided a good starting point. But if somebody bases their business case purely on the statistics that you get, whether it’s the World Bank, or the UN, or the CIA Factbook, or the BBC, or et cetera, you’re going to be challenged. Because to really understand Africa, you’ve got to be on the ground. It’s not a story that you can see in statistics. I say that for two reasons. First of all, the statistics that are measured are measured from a very Western, long-established business culture. You don’t have that across all the markets in Africa, we’re talking 54 countries that have very diverse levels of maturity in their markets, and the ability to register online, for example, or in their court systems. To rely just on those statistics, the best thing about them, like I said, it’s a good starting point and you could compare apples to apples. So you have the same mechanism for collecting those statistics if you wanted to compare entering five different countries in Africa.

For me, the number one key to success for anybody wanting to do business in Africa is you’ve got to go there, and you’ve got to see it yourself, and you’ve got to meet with your customers. You’ve got to find out and watch how they interact with your product or service. In most cases, you need to amend it. I mean, there’s a mobile phone company who captured 68% of the phone market, simply because they set up research centers in Nairobi, and Lagos, and observed what people liked and didn’t like about their phones and what was important. They quickly developed a whole suite of phones that had multiple SIM cards, because every African has at least two phone numbers. Oftentimes, more. They had super long battery life. I mean, some of their phones that can go for a month without charging.

Jeffrey: Wow!

Deanne: That’s important in Africa, where you don’t always have access to electricity. They also had local language capability. So you could type in Amharic, or Arabic, or Yoruba, or Swahili, or English. Another thing that they did that was really smart is they had a suite of phones, so it was different price levels, so that everybody could afford a mobile phone. Maybe you didn’t have a super-duper smartphone, but you just had a basic phone. But the number one thing that they did is they found out that the number one thing people look for in a phone and complain about on the phone was the picture quality. I experienced this at Vic Falls because I went with two friends of mine. One was from Jamaica, and the other is from South Africa. They were black, I’m white. Our pictures were just hilarious, because either I was glowing in the dark, or you know, I mean, it was poor. Okay.

But what this company did is they adapted the camera and provided more light so that it recognizes darker skin tones, and now you get the perfect selfie or the perfect picture. That catapulted them to 68% of the mobile phone market in Africa. So that shows how if you can take something as “standard” and as global a product as a mobile phone, and you still need to adapt it for Africa. How much more for other products that we want to bring, and companies want to market across the continent of Africa.

Jeffrey: Yeah, that’s a great case study of, I think what you’ve kind of sort of been talking about how you’re not going to be successful or as successful if you’re not there on the ground really committed to the project.

Deanne: Correct. Yeah.

Jeffrey: How big of a deal do you think the new African Continental Free Trade Area is going to be for doing business in Africa, and particularly when that business runs across borders?

Deanne: So it has the potential to be an absolute game changer. There’s obviously a lot, they say, the devils in the details and there are a lot of details. But I think it’s really amazing, wonderful, and a great example. I mean, today, the world tends to just be looking more inward and very nationalistic, and Africa is saying, “Guys, listen. We’re much stronger when we work together.” So I think that AfCFTA has huge potential, the fact that you’ve got a lot of countries that have not only signed off on it, but have ratified different things like the payment methodology, a single code for companies that will work across the continent, a single place where you can access tenders. I think it speaks very highly of Africans determination to be a strong global player going forward.

Jeffrey: It’s definitely exciting, and I think a huge opportunity. It’s great to see that it’s not just sort of on paper, but it’s actually sort of getting all these different little bits of teeth, like you’re talking about. What do you think when American or European, or elsewhere from outside businesses or business leaders are looking at Africa, what do you think they tend to misunderstand about investing and doing business in the continent? Why do they have these sorts of blind spots?

Deanne: Remember how in the 70s, and the 80s, you had Bob Geldof and everybody singing, ‘We Are the World’ and ‘Do They Know it’s Christmas’. At the time, there definitely were people that a large number of people that were starving. Unfortunately, a lot of people still think that’s Africa today. I like to tell the story about, think what you and I looked like in our high school yearbook picture. Thankfully, we’ve moved on, we look a lot better, and so has Africa. Again, it goes back to being on the ground. And if you’ve not been on the ground, you wouldn’t be aware of that. You wouldn’t be aware of the fact – I show people pictures of Africa, and they’re like, “Oh! Is that Dubai?” I’m like, “No. That’s Accra. That’s Maputo. That’s Dar es Salaam. That’s flying into Entebbe in Uganda” and people are like, “Really?” Even basketball fans, they’re like, “There’s a basketball league in Africa.” I’m like, “Yeah. The NBA is there. They played the final in Rwanda in an amazing basketball hall.” But it really requires people being on the ground.

Then, I would say the third thing is that there’s a lot of risks that they perceive that are not real. So those perceived risks is what says, “Oh, no. Africa’s too dangerous. Oh, no. It’s too far away or it’s too corrupt” or “No, they would never use my product. There’s nobody I can hire.” But those are all perceived risks. And if you’re on the ground, you see that actually that’s not it. That’s what I do. I work with companies and be like, “Let me take you. Let me share with you my experiences,” so that they have the confidence too, or at least the willingness to reconsider Africa, and put away their current views, and be open to seeing what Africa really is today.

Jeffrey: Yeah. Speaking of the importance of being on the ground, and doing that kind of base-level fact-finding. How in your experience, how accurately do projects like say, the World Bank’s Doing Business index, or some of the other sort of similar, similar surveys relating to sort of regulation, and doing business and those kinds of things? How accurately in your experience do those sort of map on to what people tend to experience when they’re sort of actually on the ground?

Deanne: So, unfortunately, the Doing Business had a bit of a scandal in the past year. I do think that it’s a good metric to use, because you’re comparing apples to apples across every country. It’s the same thing where – when I – all the companies I’ve worked with the C suites, they’re all like, “Ha!” But if you put, “Oh, it’s from the World Bank” or “Oh, it’s the CIA Factbook.” When it’s something that they know, and they recognize that brand, they’re more open to listening to the information that you’re then going to present them. That is absolutely crucial. The thing to remember though is, data accuracy across Africa, in general, is a challenge.

The Mo Ibrahim Foundation did a study and found that over 80% of African countries don’t have a birth registry or a death registry. That covers over half their population. That doesn’t mean that you can’t do business. I’ve done projects where we’re looking to build multiple international center logistics parks, and we just have to collect our own data. I go to the ground, and I travel in the countries, and I meet with embassies, and I meet with the government’s promotion agency, and I meet with competitors and potential customers. I drive all over, so you get a feel of that country. Honestly, anywhere you do business, it’s your gut that really speaks stronger than data. Even if you’re in a country that, let’s say pick a European country, or pick the United States. It’s really your gut that is also very important. For that. you’ve really got to be on the ground, and see it, and feel it and talk with people.

Jeffrey: Yeah, for sure. That kind of reminds me. I had a former Nigerian colleague. He would always say like, “Oh, the population numbers for Nigeria, total nonsense. They’re off by an order of magnitude.” Is he right? Maybe, maybe not. But yeah, I think that seems like also an underrated. Everybody calls everything infrastructure nowadays, but the sort of generation and maintenance, and accessibility of accurate data seems like an underrated form of place for an investment of, we may call it soft infrastructure or something like that.

Deanne: Agreed.

Jeffrey: Speaking back to, again, your experience of doing things on the ground and sort of walking people interested in doing business in Africa through the challenges aren’t so bad. Tell us your chocolate chip cookie story. I enjoyed reading that.

Deanne: Yeah, it was – I do genuinely love to bake. Everywhere I’ve lived, that’s what I do. Invite me for dinner, I’m bringing chocolate chip cookies or banana bread. Yeah. I had been working on a couple of opportunities in a particular country in Africa, and really enjoyed it. It was moving forward, there are a couple of different things we were looking at, and it had been going back and forth for months. Then it got to the stage where I was going to meet a senior-level government official. He just kept alluding to his little pet project.

Now, when I go into a country, I always talk about, I want to walk ahead, I want to know what are the community projects. Because to me, a win-win is not if I just improve the bottom line of a company. A win-win is when I improve the bottom line of a company and the community within which they work. Good relationships with the community is the number one way to de-risk any deal in Africa. So I had met with the Ministry of Education, we looked at building some schools. So yeah, so he kept asking this, so I shared about the Ministry of Education, what we’ve been doing, and he kept bringing it up. You could see people in the room get uncomfortable. Now, up until this point, nobody had ever asked me for a favor, a bribe, a facilitator, whatever you want to call it.

Jeffrey: So blatantly.

Deanne: Yeah. And because I’m aware of what it’s like, and so I’m always proactive and saying, “Listen, I met with the Ministry of Education. This is what we would like to do when we start. In addition, this is the training we do for our staff. This is the training we do for our subcontractors.” We’re up upskilling, introducing new talent, new skills cross the board. I’m like, “Okay/ I’ve just got to address it.” Honestly, without thinking, I was like, “Sir, I really appreciate that you have a project that you want to do. As I mentioned, we’ve met with the Ministry of Education, these are the plans we’ve put together with them. When that is done, maybe we can consider your project. In the meantime, I can bake you some chocolate chip cookies, because they’re really good, and everybody I give them to loves them.”

The room just – you could have heard a pin drop because people were like – you know. And my local partners just like, “That’s it, I’m dead.” But the senior official just looked at me and started laughing. So I was like, “Okay, So back to the project timeline we were talking about.” Afterwards, what I heard from people – well, first of all, it was just my heart. My heart was genuine. Yeah, my cookies are good. But they really appreciated the fact that A, I addressed it, but I addressed it in a respectful way. Not a wagging the finger, like how dare you kind of way or arrogant. In a bit of a playful way, so that everybody saved face. And you know, my local partner started breathing again. We weren’t put on the next — Eventually, we did end up doing the project. It took longer than we wanted. But whether that was because of that, or another issue, it’s Africa, it’s fine.

So yeah, it became a bit of a folklore. o I was at a conference a couple of months after that, and yeah, an individual came up to me and was just like, “You’re the chocolate chip cookie lady” and I was like, “Wait. What?” So yeah, it’s following me around. But again, just showing that he just wants – it was probably something that he wanted that was in his constituent, or in his local village. They don’t do it with malice. But can you just be a bit light-hearted, and show them the respect and also recognize that you don’t want them to save face. That’s again, it all goes back to this win-win scenario, that you’re not just there for your company and your company only. There’s an ecosystem that you want to improve, because – I mean, there’s one of my favorite sayings is, one brings a string, and other brings a string, and together, we finish the net. Then it’s a proverb from the Songhai people in West Africa. It basically means, I mean, if a fishing net is missing string, then you can’t use it, which is worthless. But when everybody works together, and you can finish that fishing net, you can start using it. It’s the same attitude towards businesses, that we all have roles to play. And when we work together, you’ll be much quicker to be able to use that final product or launch that final product.

Jeffrey: Absolutely. Throughout this conversation, we’ve kind of been focused, either sort of on Western business interest in Africa or domestic interest. But I’m wondering how you see China’s increasingly large presence across the continent. Is that changing the way business is being done in Africa? How much sort of genuine learning and exchange is taking place? What’s your assessment so far of China and Africa?

Deanne: Favorite question that people love to ask, and I’ll answer it two ways. First of all, I’ll answer just in terms of China. It is changing the way that business is done because the way the Chinese do business is very different. Governments across Africa are very aware of the fact that Western companies are beholden to the UK Anti-Bribery Act, or in the United States, the Foreign Corrupt Practices Act. It is challenging when you’re bidding on a tender or a PPP against Chinese firms that aren’t beholden to that. They can use whatever manners to make their bid or their PPP look better, or the brown paper bags as we call them. So it has changed it. I do think that in many countries, people are wising up to the cost of doing business with the Chinese. The cost is in a couple of areas. A, your staff do not get developed like Western companies do, because the Chinese tend to bring in their own people and somehow – or other get fees for all of them. Secondly, the quality of the work is sometimes questionable. Also, the fact that they are supposedly known for – if they are building you the equivalent of your White House or presidential palace, they have been known to find bugs in there.

Then, I think the other thing is the over-dependence on contracts that are tied to raw materials. Usually to – which are oftentimes denominated in US dollars. As the exchange rate fluctuates, China gets more and more raw materials, which is great for them, but it works in the negative interest. I do think people are more aware of it. The other way that I answer the question is like, “Guys, China’s fine and great, but it’s a known other factor. Can we talk about the UAE? Can we talk about Turkey? Can we talk about Russia?” Turkey has opened 40 embassies since 2005, and people are, “Wait. What?”

Jeffrey: I had no idea.

Deanne: Exactly. Again, I’m not saying they’re bad people. That’s not. But it’s not just, you know – we just – we want to have one bad guy, and a lot of Western people are like, “Oh, that’s China. It’s China.” Well, you better be aware of what the Turks are doing. They also do infrastructure, they focus on power, they focus on roads, et cetera. And they have their own little friends. Okay? Then there’s Russia, and they come in, they’re most known right now, for better or for worse for the mercenary side of it. When you go into the capital city of a country in West Africa and the main square has a huge monument of Russian soldiers. That shows that they have quite a bit of impact in that country, for better or for worse.

Then, you look at, let’s say, the Middle Eastern countries, whether it’s UAE, Qatar, when we are talking about agriculture. They have come in and purchased large tracts of land which they use to grow food for their own countries. Understandable. But how much are they also investing in the local economy? I don’t know. I think the UAE is also interesting because I love watching how they grow because I think it’s masterful. Look at where Emirates Airlines is going, and you’ll know where the UAE Government is going. I do also credit the UAE government with doing a lot with infrastructure. So through Dubai ports, they are investing a lot in ports, they’re investing a lot in logistics facilities, in border crossings. So it’s interesting to see where they’re going.

I think they also, just recently. they announced that they have had to stop their flights to Nigeria because of the challenges of exporting, repatriating their currency. Emirates is a well-known and respected name. I don’t think they’re doing it to be mean to the Nigerian government. It’s just, it’s a fact of life. So yeah, I just think the UAE is interesting. I do think they add a lot positively. They say that Dubai is – I mean, the nickname in Africa is that Emirates Airways is Africa’s airline. Between them and Flydubai, they’re a low-cost subsidiary. They literally do fly to so many countries across the continent.

Jeffrey: I think it’s interesting, the extent to which some of these countries like the UAE will invest in places that maybe the West just isn’t willing to do. Like the example that comes to mind that we’ve written about at CCI a little bit is DP World’s big investment at Berbera and Somaliland. They’ve been properly separated in from the rest of Somalia and democratic for, what? Thirty years now? We’ll get recognition, but DP World is willing to invest half a billion into the port there, which I think that speaks volumes.

Deanne: Yeah. Agreed.

Jeffrey: So I guess to wrap up on a sort of positive note. Which countries or maybe even just cities, regions are you the most optimistic about over the next, say, 20, 30 years, and why?

Deanne: Ooh. That’s a challenging question. Because if you mentioned one, and not the other, they’ll get mad. I think the biggest thing to understand Africa is that oftentimes, we think of market entry as going into a country. Whereas in Africa, your market entry needs to look at a city or a corridor. There are cities that honestly 80% of that country’s business takes place in that one city. So you want to look at a city, for example, like a Kinshasa, or Lagos, or you might want to look at a corridor where Mombasa is the entry point to Nairobi. Then it goes on to Kigali and Entebbe, even Juba. Those are really the areas to focus on.

When people say, where do I want to go, I always say, “What is your appetite?” And your appetite, I worked for a company out of Kuwait, Arabic-speaking, Muslim, they were very comfortable starting in North Africa. It’s like they’re brothers. Are you company in France? I’m working with a company right now in France that’s looking at Africa. They are very comfortable with French-speaking West Africa. That’s perfect. There’s – you’ve got 15 countries we can look on. That’s great. It’s really finding where you – the company and by that, I mean, the C-suite is comfortable operating, and let’s start there. That’s, as they say, the low-hanging fruit. Then, get a feeling for me like, “Oh, yeah. This is possible.” Then say, “Okay, great. From there, where do we expand?”

Jeffrey: From there, the ball’s rolling. It’s done.

Deanne: Exactly.

Jeffrey: All right. Well, I’ve enjoyed this conversation. Thank you for joining us on the Charter Cities podcast, Deanne.

Deanne: Thank you, Jeff. This has been great.

Kurtis: Thanks so much for listening. We love engaging with our listeners, so please always feel free to reach out. Contact information is listed in the show notes. To find out more about the work of the Charter Cities Institute, please follow us on social media, or visit chartercitiesinstitute.org.

Links Mentioned in Today’s Episode:

Dr. Deanne de Vries on LinkedIn

Dr. Deanne de Vries on Instagram

Charter Cities Institute on Facebook

Charter Cities Institute on Twitter