The Nigerian economy is complex and multilayered, with many opportunities and hurdles for its people. Joining us on the show today to discuss the economic landscape of Nigeria, the charter city project of Talent City in Calabar, and what it really means to provide opportunities to the Nigerian people, is entrepreneur Iyinoluwa Aboyeji! We have a fascinating discussion around the ways the Nigerian market operates and the types of entrepreneurship and businessmindedness that are found in the country. Iyinoluwa sheds light on what he calls survivalist entrepreneurialism and explains a few different perspectives on Nigerian aspiration inside and outside of the country. One of the most notable points that our guest makes is the stark difference between the American concept of monopolies and Nigerian ‘competition trees’. From there, our conversation turns to Iyinoluwa’s own professional experiences and work at Andela and Flutterwave. We also get into his education and faith before looking at the political picture in Nigeria and what this means for young business owners. We discuss the Chinese presence in Africa, feelings about this, and of course the impacts of the COVID-19 pandemic. The last part of our conversation is spent unpacking Iyinoluwa’s work on the Talent City Project and his hopes for this new charter city! Intended as a specialized tech hub away from over-crowded Lagos, Iyinoluwa hopes to attract young talent to the new space soon, with remote work being a big draw for the model. For this great chat with Iyinoluwa, be sure to join us on the Charter Cities Podcast, today! Links mentioned on today’s episode can be found below the transcript.

Transcript (edited for clarity):

Mark: Hello and welcome to the Charter Cities Podcast. I’m your host, Mark Lutter, the Founder and Executive Director of the Charter Cities Institute. On the Charter Cities Podcast, we illuminate the various aspects of building a charter city. From governance to urban planning, politics to finance, we hope listeners to the Charter Cities Podcast will come away with a deep understanding of charter cities, as well as the steps necessary to build them.

You can subscribe and learn more about charter cities at chartercitiesinstitute.org. Follow us on social media, @CCIdotCity on Twitter and Charter Cities Institute on Facebook. Thank you for listening.

Mark: Welcome to the show, E.

Iyinoluwa: Thank you very much. Thank you for inviting me, Mark. It’s been a long time since I last saw you. And you look good, minus the eye bags, but you look good.

Mark: Thanks. I appreciate that. I’ve been trying to keep up my beauty routine in quarantine. When you travel around Africa, you get a sense of the different cultures of different people. You’re from Nigeria, so why are Nigerians so entrepreneurial?

Iyinoluwa: I think, like I always tell you, Nigeria has a mix of interesting characteristics that you’ll find in specific kinds of emerging markets where people are also very entrepreneurial, like India, like certain parts of China, like Brazil. It’s a dense population of people spread over a very limited geographic area. At the same time, there are very weak governments, meaning that there are no guaranteed social safety nets.

For most people, entrepreneurship is a survival mode. It basically is the only way that you can provide for not just yourself, but for people around you. Then at the same time, the market is around you as well. It’s not just a question of there’s no opportunity and you must do entrepreneurship to survive, where mostly it’s trading people. It’s the only path to real wealth, but at the same time, the market is all around you. You’ve got how many million people around you?

You try and find a way to serve them and keep increasing that scope over time. I think we’re very, I’ll say survivalist, entrepreneurs, and that’s why you sense on the surface the deep entrepreneurial spirit that you find in Nigeria.

Mark: There’s definitely a sense of hustle that you don’t see in some other emerging markets. I don’t think it’s a coincidence, for example, that we get emails from Nigerian princes, saying they are from Nigeria. We’re not getting them from the DRC, we’re not getting them from Ecuador. Obviously, that’s not the full story, but there is this sense of hustle, the sense of urgency that you get in Lagos that isn’t present everywhere.

Iyinoluwa: That is definitely a hustle, but I also say that because I’ve studied the issue of cyber fraud a lot and we have monitoring centers. A number of those e-mails are actually done to cater to a specific demographic of losers.

Mark: Sure.

Iyinoluwa: Not in a bad sense. I mean, just that the average person sees an e-mail from a Nigerian fraudster and knows this is bad news, but the people who don’t see that are perfect targets. Because then they can be suckered. It’s a weird thing. That said, I also think there is definitely a culture here, and the reason why people do those things is because these are the trades that people learn. People here want to get rich quickly. In Nigeria, you tend to think about things in terms of stark differences.

On the one hand you have survivalist entrepreneurship. On the other hand, you have mega capitalism. You get my point. There’s no in-between. There’s no, “I’m a small business.” Every small business owner wants the hammer with the federal government contract and become Dangote. That’s the dream.

Oftentimes, what happens is people pull other people along this path with them and then create that trail. That’s how you see Nigeria work. There’s this really cool YouTube video talking about the apprenticeship system in the Igbo trading ecosystem, where you work with your boss for a few years and he sets you up with a shop to compete with him. That’s how Nigeria works. Something’s working for you, you’re making money, you have to put your friends on. The way you put your friends on is not by employing them, because people have ego issues. You put them on by setting them up to compete with you. Which can be a very, very weird concept if you’re not Nigerian, but that’s how it works here.

Mark: That’s an interesting point about the fraudsters that you mentioned. I read a few years ago, for example, that they intentionally include typos in their e-mails, because the people who respond to the typos are the suckers. If it’s a very polished e-mail, then smart people would respond and then the scammer has to spend a bunch of days trying to convince them to wire $5,000.

If it’s somebody who responds to an e-mail with a bunch of typos, then they’re probably much easier to convince. That point about setting up these competition trees is interesting. You see this in different migrant populations in the US as well. For example, Chinese migrants often have Chinese restaurants or laundromats. They have these social networks that then when a new family comes, they help raise the initial capital to seed either a restaurant or a laundromat.

Now, obviously you don’t want to compete directly. You want to be a little bit further away, but it is obviously in the same business group. I think these, what might be called kin networks, are somewhat under-appreciated in America, just because the US has this tradition of individualism, where we really can’t name our great-great-grandparents. In a lot of other societies, you can go back five or six generations.

Iyinoluwa: You know what’s really funny about it is that, and this is something I struggle to explain to American entrepreneurs when they come to Africa, monopolies are an American concept. In our society, we have a saying, “you can’t buy the market.” One person can cook for an entire market and the food will be finished. If the whole market decides to cook for one person, he can never finish the food and so we say, “you can’t buy the market.”

The American concept of monopolies is a very interesting concept to us, because it doesn’t exist. It’s just something that we never see. Society actively breaks up monopolies. In fact, if you even have a monopoly, the maximum a monopoly can be is maybe 60% of the market. There must always be an equal and opposite competitor somewhere that will be part of that. The reason why is because people create these competition networks for themselves.

For example, in Nigeria, we have three major cement players. Dangote, BUA, and you have Lafarge, which is a foreign company. All three of them engage in the same business and compete in exactly the same way. All are from Kano. Literally, that’s just how everything works. You have these dynasties that create competition for themselves and grow themselves and replicate themselves.

Mark: Cool. I want to return to this idea of a Nigerian entrepreneurship a little bit and push back, because Nigerians are the best educated immigrant group in the US. They’re better educated than Koreans and Japanese and Chinese, etc. I’ve worked with a few Nigerians. My typical impression of a Nigerian migrant, whether first or second generation, is they become a doctor, or lawyer. My former colleague used to joke, “If you’re a Nigerian, you can become a doctor, an engineer, or a lawyer. Or if you’re a woman, you have the added benefit of doing one of those and also being a housewife.”

There is this upper-middle class professional career trajectory, at least that’s emphasized in the Nigerian-American communities I’m familiar with, but that isn’t really the story of entrepreneurship that we associate with Silicon Valley, or with Nigerian entrepreneurship where it’s really trying to build something from scratch.

Iyinoluwa: I’ll tell you, that’s what you see. There are two elements to it. The first is that entrepreneurship in Nigeria is survivalist. In the country, there’s no option. Otherwise, people would actually take jobs, but there are no jobs. Now when they go to the US where there are jobs, the thinking changes. What you have to ask these people is what they do with their free time, because a lot of them are moonlighting, shipping cars back to Nigeria, building homes in Nigeria that they rent out, running all sorts of complex business schemes in Nigeria, which is why the flows between Nigeria and the diaspora are so huge. $25 billion. Because people are in the US.

I have friends of mine who run huge factories from Canada, from the US. We’re moving into this world of virtual work. Nigerians in the diaspora have mastered it. They control entire enterprises online, through phone calls, and through trusted networks that work with them here in Nigeria. What it is to attain that level of educational attainment, they believe it gives them respect in the US. They believe it gives them a status in the US.

The reality of the matter is also that Nigerians were entrepreneurial in the US and looked upon with suspicion for all sorts of reasons by US authorities. Also, if you present as a doctor— this is a slight tip, I hope the IRS is not watching—but you’re sending huge amounts of your money back home to do business in Nigeria. Guess what happens to your taxes? IRS isn’t looking for it. By the time you look at all these factors, you get a sense of why Nigerians present the way they do in the US, but don’t be deceived. The entrepreneurship streak is still deep inside and what you really want to find out is what they do nights and weekends.

Mark: Sure. I think that the point you brought up about this expat network and how they’re investing again in Nigeria, it’s really important. I think that’s often under-appreciated in the development conversation.

Shenzhen, when developed in 1980, was a special economic zone. It had a few fishing villages, about 100,000 people. The first 17 years of its existence, some 80% plus of all foreign direct investment came from Hong Kong, which is actually walkable to Shenzhen because there are also Hong Kong territories on the mainland that were controlled by the British government. All of these kin networks were very important to that early investment. It’s not these big multinationals, they’re important, but a lot of times the initial kick for development comes from, “My cousin has this project. Let me introduce you to him”. Then that’s how the initial capital is raised to get the small and medium-sized enterprises to start scaling.

Iyinoluwa: Exactly. I would argue if you look at the last 10 years of foreign direct investment into a country like Nigeria, or 50 years actually, let’s use a longer time horizon. What you find is that whenever there is a market shock, direct foreign investment naturally goes down, aid actually goes down, shocking as that may seem, even though Nigerians need it more. The only thing that has stayed stable over the last 30 to 50 years of development in Africa is remittances. Today, remittances even comprise a higher contribution to the balance of trade of the country than other forms of inflow. FPI, which is hot money, FDI, remittances, official aid. Remittances are the highest.

This is why it’s so important for governments to pursue what I would call “diaspora-friendly” policies and to be very out there about supporting their diaspora in other countries to trade with them, because the reality is that America is not going to trade with Nigeria by itself. A big proportion of American trade is Nigerians who understand Nigeria very well, now working with Americans to make the opportunities on the continent more apparent.

You can only reap those benefits when you have things like a decent exchange value currency, floating exchange rates, when you have good investment policies for your own people. Not even for the foreign investors, because a lot of countries when they build charter cities, they’re focused on, “How do I make is attractive to foreign investors?” People always ignore, and maybe as an economist you would disagree with me, that trade is not just a purely commercial composition. There’s emotion involved. There’s trust involved.

Those trust bonds between the diaspora are much stronger than the trust bonds between two random people doing trade on the internet. I keep saying that the reason why China has become such a trading center for the world, at the end of the day, is because of their active push to build diaspora clusters in multiple different countries. At the end of the day, all the trade from China is coordinated through Chinatowns. Without Chinatowns, trade from China would not happen. It’s not a matter of cost. It’s just a matter of representation. I think there’s a big case for governments, especially as we look into this new future, post-China and COVID, to say, “Okay, how are we going to empower diaspora in multiple different countries to represent us?”

Mark: I think that’s an important point. Obviously, the numbers have to make sense, but most decisions aren’t going to be made by the analysts in the back of the room looking at a spreadsheet. Most of these decisions are made by the people in the room shaking hands who can look each other in the eye, or at least now in the COVID world, look each other in the eye on Zoom and do a virtual fist bump and think, “I trust this guy or gal to keep up their end of the bargain.”

That level of trust is important and obviously that level of trust can be achieved more easily when there’s a shared background, when there’s a shared understanding, when there’s a shared worldview. That often does come through in international trade through diaspora networks.

Iyinoluwa: Exactly. Something important to keep in mind.

Mark: Back a little bit to refocus the conversation on entrepreneurship. You founded both Andela and Flutterwave. Walk us through the process of those.

Iyinoluwa: For both of those companies the story has been told again and again, highlighting the challenges and the opportunities of Nigerian entrepreneurship. They both happened because we came upon very opportunistic parts while we were on a previous entrepreneurship journey. For me, I started my entrepreneurship journey at the University of Waterloo. I was part of something called the Velocity Program.

The Velocity Program just tried to help students to get into entrepreneurship very early. The university has had a long history of young people in school starting companies before graduating. That was how the BlackBerry was born, that was how Kick was born. I think money from one of the founders came into the school to basically build this Peter Thiel-type program, but in a very polite way. Where basically the school was forced to create a residence for intending student entrepreneurs and a space for them. And then they cultivated those qualities on campus with a view towards them graduating with a business in hand.

It worked really well. Lots of great companies came out of it; Pebble, Vidyard, BufferBox, Atomic Labs, they’re called something else now. Lots of great business came out of that playground. Ethereum started up there, sort of. I came out of that program. I had a company. I went back to Africa to try and implement it. Didn’t work out and then I started to morph the idea.

Andela started out because I had a conversation with an entrepreneur called Jeremy Johnson, who is absolutely the best education and talent entrepreneur the world has. He had built a company called 2U, which was an online education company, but he was thinking carefully about a world where quality education costs real money. How do you make this education worth the investment for a child in Africa?

That was his genius contribution to the world. The education that a child has must be worth something. You can’t just tell someone, “Pay $40,000 to go to Harvard.” There’s no economic return. In the US, you can make that decision, because you got student loans. In Nigeria, $40,000 is real money.

The hope is that you can generate at least $100,000 of return on the back of that kid making that investment in education. That was the vantage point by which we built Andela. The idea was very simple: find talented young people with the capacity to learn, put them through an extensive training program that teaches them how to build software, how to be engineering and technology leaders, place them with companies that are willing to pay for the talent, and then recoup your initial investments in those young people, as well as give them a living wage and purpose.

It was a beautiful program. It scaled incredibly. Obviously as you can imagine, the model has changed, but the core concepts remain core to a bunch of new innovations in the tech space. People don’t know, but the concept of ISAs actually came out of our experiments on Andela. Hopefully, one day the Lambda School guys will give us the credit for it. The idea was that you can train these people much more effectively, you can provide them some guarantee, and that’s basically how it works today.

Mark: I definitely want to get into that and your ability to talent scout, because I think that’s been a consistent theme in your career, identifying and empowering young talent. Before that, I want to touch on a point you made regarding education, on how it needs to teach real world skills. I have a buddy who works at a university in Ecuador. I went to give a talk there last October. This is one of the best universities in Ecuador.

One of the things he mentioned is that he had your view, a little bit skeptical of this traditional liberal arts education, because it doesn’t really teach value additive skills. What he found in Ecuador was that a percentage of their population, they might be part Indian, or they might be poor rural peasants, who would go to university and they would learn these cultural skills that would allow them to interact with the Ecuadorian “elite.”

Because there is this big class/cultural divide in Ecuador, where typically the people who are more of European descent are on the upper echelons and the people more of Indian descent are on the lower echelons. What this cultural education did, which is somewhat difficult to capture in an engineering degree, it’s something they have a class on. How do you hold a wine glass so you can go to a dinner with all the fancy people?

Iyinoluwa: Like the soft skills.

Mark: Tell me about this how you teach those soft skills and what that looks like.

Iyinoluwa: We used to do something called improv. We used a lot of improv and roleplay to teach you soft skills. The fellows, as we used to call them, would do their technical classes during the day and in the evenings, they did improv and soft skill sessions. And we became very well known for that, for providing people with soft skills. I think that’s very important.

What I think is not as important is just studying the classics. Let me put it this way, it’s not that I don’t think it’s important. I think it’s stuff that the student can do on their own, when they have the luxury of feeding themselves and their families. If they know how they’re going to feed themselves and their families, then all of a sudden, Plato seems more interesting all of a sudden. All sorts of philosophy and all the high-minded thoughts and wine seems more interesting. You’re never going to learn how to drink a bottle of wine if you can’t even afford wine.

Mark: Hopefully only a glass of wine.

Iyinoluwa: Hopefully, a glass of wine. If you can’t afford wine, you can’t afford to hobnob with the rich and the mighty. It’s never going to be interesting to you. It’ll be preparing you for a scenario you’re never going to encounter. After you have that money as many of our fellows later discovered, those are skills you need to learn. There’s always resources online that help you learn it just in time. Do you need to spend $40,000 that you don’t have just to learn that? Do you need to get a degree in nephrology? I don’t think so. I think you need to learn a skill that helps you put food on the table today.

Mark: Today, you are a venture capitalist and before Andela, for example, you were training talent. Then as the executive of Flutterwave, obviously, you had to hire talent. How do you think about talent evaluation? How do you see the kid who has a lot of potential but is maybe a little bit rough around the edges and know that this person is going to be successful? How do you see that and then empower them to achieve that success?

Iyinoluwa: Many people have many ways of evaluating talent. Some people look at talent from the point of view of, “Are they intelligent? Do they either have some innate intelligence or IQ?” I tend to see these things a little bit differently, which is that at the end of the day, what determines how valuable talent is, is the amount of effort they are willing to put in in polishing themselves.

When we designed talent funnels at Andela, and even at Flutterwave, what we were particular about was creating a system that gave everybody a default yes. You’re automatically accepted into the fellowship. However, you have to score X, Y, Z on these technical tests. You have to have these type of character traits. You have to have this level of knowledge.

We keep raising that bar over and over and over again, because in that process, the knowledge, whether you’re accepted into the fellowship or not, is yours for the rest of your life. If you show us that you’re willing to make these sacrifices to attain a certain level of knowledge, then we can take that as willingness to do the work required to excel at it.

Oftentimes, we were right in that equation. Obviously, are there challenges to it? Yes. Are there inequities associated with it? Yes. We try to reduce those by providing people with opportunities for meeting with a group of people, getting a laptop, getting access to the internet, getting the right support along their journey. I think a lot of talent initiatives fail, because there is some concept of the chosen ones. I think there’s no concept of the chosen one. I think talented people pick themselves by virtue of the amount of work they’re willing to put into learning. That’s my opinion.

Mark: One thing we’ve discussed in the past that is how Nigerian entrepreneurs and Western entrepreneurs typically face a different set of challenges. One of the things that you mentioned is that when you’re pitching a Nigerian company in the US, you sometimes have to use an analogy that it’s Uber for X, or a Stripe for Y, even if it’s not functionally that, because the market environment in Nigeria is different. Can you explain a little bit more about that?

Iyinoluwa: I feel when you’re pitching to US folks, US folks are very navel-gazing, naturally. They tend to think the whole world is the US. On some level, they’re probably right. Oftentimes, the wholesale copycat approach doesn’t quite work. One of the bigger challenges is that how do you explain what you’re doing in terms of how the other person would understand? Because the point of communication is not to express yourself like people think, in my opinion. It is to be understood. That’s the point of communication.

If I’m showing up in US and it looks like Uber, okay, I can say it’s Uber. I’ll give you an example. We have a platform that provides lease-to-own services to drivers on ride-share platforms. If we’re using the analogy thing, it’s more a Fare than it’s Uber. However, we have to just say, “Oh, we’re building Fare, or I’m sorry, Uber,” because most people don’t know what Fare is, “of blah, blah, blah,” just so we can gain acceptance. It’s more complex than that.

It’s not just about ride sharing, it’s also about leasing the cars, because the Uber model assumes car ownership. In Nigeria, a car ownership is 2%. People don’t have cars to put on the road. It’s a very simple thing. You have to give them cars to put on the road, so you can do a ride-sharing thing. These are some of the examples of the nuances with doing business in Africa. There’s specific, assumed infrastructure and stuff like that that exists in the US that doesn’t exist in Nigeria.

Mark: When do we see a Nigerian company in the US, or in Europe?

Iyinoluwa: I think we’re going to get there very soon. I mean, a lot of people who use Calendly don’t know what’s made by Nigerians.

Mark: Really? That’s interesting. It’s already there.

Iyinoluwa: Right there, right? There’s many other examples of products you can use every day, but you don’t know that Nigerians make it. I think right now, it’s probably because there’s a reputational bias issue. In the early days of Andela, when we told people we’re a Nigerian firm, that was a very short way to ensure we never got a call back.

Firms are sometimes hiding themselves, they put in US representation. I think there’s an ambition issue, also. Many years of conditioning and being made to believe that the only people who are worthy of innovation are people in the US and Europe. People believe that stuff. There is work to do in terms of decolonizing people’s minds in that respect. That’s what is there. I’ll say for free that the reality is it’s coming sooner than people expect. The world is becoming a much flatter place and great products will emerge from anywhere in the world to dominate, provided the big four leave some room. I think we’re getting there faster than people think.

Mark: Your father is a pastor. How did that religious background affect your career path and entrepreneurial decisions?

Iyinoluwa: I don’t like to use the word religious. We’re a very faith-based family. That background really showed me quite a bit in terms of the many things that are intangibles. That are not factual, that are emotional about building something special, especially in emerging markets.

So much of it is luck, as people would call it. I call it grace. A lot of it has also taught me the importance of faith in the work that I do and has given the work that I do some level of purpose. I like to joke with my father, “He serves God. I serve the people who serve God.” For me, it’s really played a role in a number of ways. I’ll say first of all, it’s given me the ability to stay on this path for so long. This year would be my tenth year in entrepreneurship. Despite a lot of disappointments, as well as blessings, one understands that the core of why they’re doing this, with so many instances over the years and evidences of God’s faithfulness, makes it an easy choice and makes one understand that they’re living their purpose.

The second thing is there’s a lot of things that seem not to make sense in the moment, but over a period of time, could, because they are not “rational decisions.” I am the first person to tell you, I don’t only make rational decisions. I try to make a lot of them. My life isn’t entirely guided by things people can see. A number of my thoughts and patterns and ways of doing things are heavily influenced by my faith-based angle and my spiritual angle to seeing things. Then I’ll say finally, it really gives one a solid basis for ethics in business. Many things are very situational in the way that businesses operate. Anybody who’s run a business, or been close to people running a business, knows that you’re walking into all sorts of dilemmas every day.

However, being faith-based has always helped me to figure out what that thin line looks like and to avoid it, even when the decisions that need to be made are very difficult or are unpalatable. That has helped me so far. I’ve not been in any scandal or anything like that. If people don’t like me, maybe it’s because I didn’t stay long enough at the company. That’s a good reason for people not to like you.

I’ve never had to result to any underhanded tactics in dealing with investors, or co-founders, or anything like that and I’m proud of that. I think that it really gives me a real moral compass, the things that I wouldn’t want, that don’t comply with the tenets of my faith community and the laws of God, I just try to just stay away from. It helps me a great deal.

Mark: What advice would you give for entrepreneurs today, with a particular focus on African entrepreneurs?

Iyinoluwa: My biggest advice is that you need to understand society depends more on us as entrepreneurs than they can depend on politicians. We have an imperative to change society by doing the work we do. We need to be willing to level up. We need to do more to level up. We need to do more to show the right level of seriousness in the work that we do and have an ambition for skill. Because if the work that we’re doing doesn’t reach enough people, then it’s all for naught, which will be sad.

I think there’s a big conversation to be had there about African innovators being more ambitious, coming together to build interesting things, not just working in silos. Ultimately, understanding that the work that we do is to serve people and to provide the basis of development for our societies.

Mark: You gave a TEDx Talk where you tell the African elite to “grow up.” Do you think American elites are grown up?

Iyinoluwa: I think there’s definitely an infantilization of the elite across board. It’s followed by this level of moral indignation that stems from this belief that you’re responsible for your success, in my opinion. Elites of all kinds should grow up. That’s really what it is.

There’s something that Jack Ma says that never left my head. He said, “Look, when you’re a millionaire, you can say part of that is because of your hard work. When you’re a billionaire, so many things had to come together in incredible ways for you, that made you, that gave you where you are today, that you have no right to basically consider that wealth to be something that accrues to you alone.”

Mark: Sure.

Iyinoluwa: I think the lesson there is basically that if you’re elite in any society, you’re privileged enough to have the money, the knowledge, and the power, to determine where that society goes. It is on that basis we should evaluate your significance to the planet, not on the basis just of your riches.

For what it’s worth, if you look at the way people like the Koch brothers spent their money, for good or for bad, they had an influence on American society. Don’t expect billionaires to be complaining about how stupid the masses are, that they’re following Donald Trump— not going there. You have the money and the resources to fight and you should. You should. You shouldn’t just capitulate and take an agenda that’s forced on you. You have money, because you have a point of view to defend. Ultimately, that’s what your money should be used for, for good or for bad.

Mark: Sure. I think that its important that the elites of society have a vision for what a good society is and try to work with others to implement and to create that vision. I think at least one of the challenges in Africa, at least one of the jokes, is that Nigerians only exist outside of Nigeria, because otherwise when Nigerians are in Nigeria, they typically identify with their tribe or ethnic background. Is there a degree of truth to that? Then how does that relate to the challenge of getting elite cooperation to focus on this broader social mission?

Iyinoluwa: There’s that perception. I’ll argue that the elite actually spend a lot of money continuing to push that perception, because it protects them. A society like Nigeria’s does not lend itself very kindly to meritocratic selection processes. At least not yet. People tend to be represented on the basis of their tribe, or on the basis of their religious leaning. For example, if you want to be president in Nigeria, you have to be Muslim, or Christian, or southerner or northerner, and then it rotates in that way.

It’s Christian South, Muslim North, and then maybe some variations of the above. Why do I say that? I say that to say that the reality of the way society is designed is that it provides a lot of incentive for elites who are typically on the same page to divide their people on the basis of religion and tribe. They spend a lot of money enforcing those divisions, because those divisions give them legitimacy in sharing what we call the national cake. That’s the way things have been designed in this country.

In reality, abroad, you just have a national identity. You’ll have a green passport. Because the society is meritocratic, no one’s going to give you a slot because you’re Nigerian. Maybe they’ll take slots away from you, because you’re Nigerian. You now have a new appreciation for meritocracy when it happens, especially to somebody from your country. I think that for our elite, the challenge for them is going to be how to rise above this tendency to carve out for yourself a piece of the national cake by virtue of your representation, by tribe, or by religion, and start to build a coalition or an army of young people who meet the meritocratic criteria for any reward, or accomplishment, or appointment or whatever from the states. That’s really how we’re going to be able to shift that.

Again, the poor masses cannot be leveraged with politics and with division to then give a slot to the privileged. It has to work the other way around. How does that look? I have a lot of respect, as much as people may not agree, for philanthropists who say, “I want to give scholarships to people from my village.” I think that’s a good thing. “I want to give opportunities to people who come from where I come from.” I think that’s a good thing, because then that means that everybody acknowledges that at a higher level, meritocracy will be the bar and I have a responsibility to push as many people as possible towards that bar.

What happens now, unfortunately, is the elites say, “Oh, there is no Igbo person on that council, or there’s no Yoruba person on that council, or there’s no– and I should be that person.” Using the poor as cannon fodder for their own ambitions while it should be the reverse. You should be pushing the poor towards that.

I think the earlier nationalists of Nigeria understood that. If you listen to the Sarduana, they were fairly big on it and that was what it was at the time, so I’m not begrudging them on that. At the end of the day, they were very passionate about the economic and intellectual upliftment of their people. They wanted to push more and more of their people towards that bar of meritocracy, which was why the Sarduana sent a lot of people to school abroad and created a university. There was a competition of sorts in that respect. I think the moment that Nigerians and Nigerian elite are able to revert back to that mentality of thinking “Our job is to push our people forward,” so that we can have the meritocracy, we can meet the criteria of meritocracy required to hold office in this country, that’s when the country starts to change.

Mark: Sure. Are you optimistic about the future?

Iyinoluwa: I am optimistic, very optimistic. However, I do understand that we will go through some very dark nights before we see the light. I’m just waiting for the bottom.

Mark: How do you think demographics play into this? Because Africa has a very young population, yet some of the leaders are still quite old and we’re running into this challenge in the US, where you have both our presidential candidates are over 75-years-old—the “okay, boomer” meme. Has that meme caught on in Nigeria with such a large young population? There might be more of a demand for a seat at the table and this hope that they can bring a new mentality, a new attitude that ideally leads to some positive changes.

Iyinoluwa: I think what’s happening in Nigeria is that there’s a slow realization that there’s only so much you can do without political power. I think just like in the US, we decided to ignore politics. That was our coping mechanism. “They’re all crooks, ignore them.” I think what COVID-19 is showing young people is that was not such a good idea. Because these guys clearly don’t know what they’re doing.

Even worse, they’re imposing their spawn on us as the leaders of this new economy who are taking commercial advantage. How else would you describe some of what has happened with America? In Nigeria, it’s the same. I think that’s provoking new kinds of conversations with young people saying, “We can’t just ignore these guys, even though government is not as relevant in our lives as they used to be with a previous generation’s life.”

The truth of the matter is, our parents were brought up on the value that government is supreme. Government paid for college, sent them to war, gave them health care, told them when to get out of the house, so they wanted to stay indoors, fought their wars. The government did all that. When we came in, we came into financial crisis. Government has been a string of incompetence for many people in our generation. We just consider them a joke.

However, political power is the foundation of organized society. You can’t do anything without that mandate. As young people come to that realization and they wake up and they say, “Hey, if we want to reach this vision of the future as fast as we hope we can, we have to engage government. We have to have a seat at the table.” Until there is that desire, nothing will happen.

Mark: I think that’s interesting. To return a little bit to the tech conversation, there have been reports, not since COVID happened, but I think over the last year, of a lot of fintech companies in Africa raising money, particularly from China. How has China influenced the tech ecosystem in Nigeria? Then more generally, with Belt and Road, how is China influencing the broader discussion?

Iyinoluwa: Right now, there are the beginnings of an anti-Chinese backlash. People are not as welcoming of China as they used to be, particularly in the face of discrimination of black people in China. Prior to now, there was a sense of cooperation and respect. As you know, many young people consider China an important trading partner. Many Nigerians consider China an important trading and infrastructure partner. What remains to be seen is what COVID makes of that collaboration.

Mark: There were all those reports of Africans being abused in Guangzhou, and the McDonalds that said no black people can be allowed. It seems as though the conversation has receded. In Zambia, China is asking for the third largest mine in exchange for some debt relief. I think there is a question of continued involvement of China in Africa and what that looks like.

We’re recording this on May 1st and it’s going to come out about a month later. This COVID conversation might be a little bit dated by the time that happens. Nevertheless, I think because a lot of our listeners are in the US and aren’t really thinking about how COVID affects emerging markets, Lagos is a city with 20 million people and a lot of them live in slums. How do you do social distancing when you’re in a slum? How do you have a lockdown when people need to work daily in order to put food on the table? How is Nigeria dealing with these issues and what can we expect?

Iyinoluwa: I think that there was a lot of lethargy on the part of the government in the beginning. I don’t think they took certain things as seriously as they should have, particularly expanded testing. Now there is a realization that we’re playing with fire. I would even say, Lagos seems like it has some stuff under control. It’s going to run out of beds in a few days from now, but it seems like the private sector will rise to the occasion and there’s all sorts of other provisions that could be in place to provide support.

However, what I’m really afraid of are the sub-nationals where governance is very weak, like in Kano. Kano has had 150 deaths over the last four weeks. People believe those deaths are COVID-related. That’s more than at sum total of deaths from COVID, because we have just 40 deaths from COVID.

People are looking at Lagos, but Kano is also a very big population, huge. Almost as large as Lagos. I’m really looking to see what happens with governments when we get to that point. There’s also the reality that social distancing is a myth here. It’s almost impossible for all but people who can afford it. There’s all sorts of other stuff that also has to be considered. At the end of the day, I think what is going to end up being our saving grace, or could be our saving grace, is just the fact that we’re a majority young population. I hate to sound this callous, but no matter what the death count of COVID ends up being, I’ll be very surprised if it matches that of AIDS or malaria.

Mark: I think that’s probably right. I think the counter example is that AIDS is infectious, but it’s only sexually transmitted, so there are ways to protect yourself. With COVID, it’s much more infectious, but the end result might be lower deaths. As we’re seeing in the US, the cost of achieving those lower deaths can end up being very high just because of the reduced amount of economic activity.

Iyinoluwa: I think it’s also helpful to keep in mind that this is not a disease with a very high mortality rate. If you’re infected with HIV, the chances you’re going to die are way, way, way higher than if you’re infected with COVID. Do I think that people are going to be infected? Absolutely. Do I think many people will die? Perhaps. Not nearly enough to register, quite frankly, if I’m being honest.

Mark: Sure. I think one of the other interesting questions is then the second-order effects of COVID. For a lot of African countries, Nigeria being one, budgets are based on oil exports. The oil price has cratered, famously going negative for futures for a few regions a few weeks ago. What does that impact have on the Nigerian budget and how does Nigeria, and also just generally Africa, adjust to this new reality, especially because it’s increasingly looking like there will not be a V-shaped recovery, and so natural resource prices are going to be depressed for a number of years going forward?

Iyinoluwa: That’s what’s going to happen. I think that Nigeria now has important questions to ask itself about its fiscal future. I think that sub-nationals will take the lead in terms of the response, because the national government just doesn’t have what it takes to lead on these issues. That’s going to create an interesting dynamic, particularly when it comes to investors and young people’s relationship with governments.

Abuja is very far, nine hours by car, an hour by flight, which very few people in Nigeria can afford. It’s very difficult for you to register your complaint with Abuja. When sub-nationals become the center of government, because the national government doesn’t have the resources to maintain its federal might, that becomes an interesting proposition, because what that means now is that government comes closer to the people. It also means that a lot of people are more accessible than you typically would imagine.

It also means that many states will be jostling for economic opportunities. They won’t be “defaulted.” When that happens, that’s going to be an interesting opportunity for charter cities in my opinion. Because every state would be looking to build out economic opportunity for its people and many states already recognize, and it just takes one state to prove it, before others start to realize the power of encouraging private enterprise.

I think that as that starts to happen, federal might becomes less and less important and states become the nexus point of governance. You’re going to see some interesting policy adjustments and changes. I’ve always maintained that Nigeria is like a nation of 36 countries. All different in their skills and capacities and abilities, but it’s being governed as though it’s one country. I’m glad that oil is going to create more independence for sub-nationals in this country, because it’s about time.

Mark: I think that’s going to be an interesting trend to see, because I think governments are going to have a much greater appetite than they would in the past for new ideas for encouraging private enterprise, because they’re going to need to create new sources of revenue for themselves. If you look at tax collection in much of Africa, for example, less than 10% the population is actually paying taxes.

If you’re able to create a charter city that has a revenue sharing agreement with the government, then this can create a large amount of wealth that can help finance a lot of other government services. I think there’s a lot of interesting stuff to talk about cities, but there’s a joke I like to tell about cities. You can start a city in three ways; you could be a government, so that’s Abuja, that’s like Astana in Kazakhstan, like Brasilia in Brazil. Or you can have an economic rationale. Typically, it’s a port, or sometimes a mining community, that starts off with this number of people that then grows over time to become a city.

Or the third reason is you could start a religion. This is like Salt Lake City in Utah, which was started by the Mormons. There’s this interesting example in Nigeria, it was reported several years ago in The Guardian, of a church that was effectively acting as a city government. It was paving roads, providing public goods, providing education services.

Iyinoluwa: Canaanland.

Mark: One, can you tell us a bit more about this model? Two, how scalable is it?

Iyinoluwa: I think you’re going to see a lot more of that, but Canaanland is an interesting vision. You had this uber-charismatic preacher wanted to grow his church and then created this community with a university, industries, and regular events. I would argue that all over Lagos to the Ibadan Expressway—Ibadan is one of the second largest cities in Nigeria— there is a train of different churches that have done the same thing.

The church my father leads also has something called Ajebo. It’s a church camp. We also own another camp in the south. This is a very tested model, but I think anybody who knows Bishop Oyedopo knows he’s an administrator for excellence. He just took his to another level. Faith is a big part of people’s lives. People go there and they live there and whenever they go for church programs, or even whenever they don’t want to go for church programs, they live there.

There is going to be more of those things, because there’s more development along that axis of society. It’s going to be interesting to see what happens. I think that’s where we are. Now in terms of what we will see going forward, I think the first trend would definitely be company towns. I definitely see that happening. A number of companies are already starting to have those conversations about leaving Lagos and moving somewhere cheaper, particularly for large portions of their workforce that are strategic to them but have to be maintained at a much more reasonable cost.

People are looking at setting up a company town, where they can provide perhaps more access to people. I think those are examples of things that would definitely happen over time. I think that ultimately, you’re also going to have governments positioning for those jobs that come from those company towns and that’s where the opportunity to revenue share and provide infrastructure support for these companies becomes real. Obviously, in a depressed economy, you can’t expect the company to devote the vast majority of its income, or debt, to such intensive capital expenditure projects.

There will be that collaboration between infrastructure providers and the government. There are variances of those things already happening. If you look at Eko Atlantic, Orange Island, Banana Island, or Lekki Free Trade Zone, there’s already these things happening all over Nigeria at present. There’s already a clear path towards that kind of arrangement with multiple governments across Nigeria. Others are joining the ranks every day.

Mark: I think that’s right. Though I think what are the challenges is you get all of these in Lagos, as you mentioned, Eko Atlantic, Lekki Free Trade Zone, where you have a private sector developer that’s providing relatively good public goods inside that development. But then you have the challenge of Lagos, a city of 20 million people, how do you then build the connections? Cities to a certain extent can be judged on their labor market, so they can be judged by the average commute time. If the average commute time is extremely high, then there’s a lot of productivity loss by people waiting in traffic, or by people taking buses.

When thinking about the future of Lagos, by 2100 it’s supposed to have a population of about 80 million people, while we are seeing these private developments spring up to provide some of these public services, there’s obviously still a role for government integration with all of these different islands and better transportation infrastructure. What does that look like? If we look at the 19th century, for example, in Paris, they bulldozed some slums to create these highways so they could march troops through so there wouldn’t be revolutions. Lagos doesn’t really have that risk, because the capital, Abuja, is in a different location.

At the same time, there needs to be some broader integration of the better transportation infrastructure in Lagos, given the traffic. That requires a role for government. Do you think government is up to that challenge now, or might be come up to that challenge in the future?

Iyinoluwa: I think it depends on the leadership of Lagos. That’s a very important topic that no one really knows the end of. I think if you look at Lagos since 1999, and maybe you do a Google Earth review, you can see that Lagos’s evolution has not been flat. It has just been very chaotic and organic.

Lagos hasn’t shown the capacity to plan itself, so to speak. It has a level arrogance that may prevent that reform from happening because it’s the seat of commerce and there are a lot of companies there already, so there’s no incentive to change. I think you’re going to have two things happen ultimately. One thing is that there’s a bunch of southwestern states all of whom are under incredible revenue pressure, all of whom have very progressive leadership, and who are eager to build out of Lagos.

You might have something like a north eastern corridor similar to what you have today between New York, Connecticut, New England and so on and so forth. You might see something sprawl out from Lagos in that way. Then I think you might also see a West Coast emerge. What do I mean by West Coast? I mean, people just literally saying, “I’m tired of this. Let’s go and set up a brand new society somewhere else based on these lessons and with a specific set of values,” which is what we’re trying to do in Calabar ourselves.

We start from the right principles. Our areas are zoned. We have the right public-private space balance. I think those are the two options I see emerging out of Lagos.

Mark: Cool. Let’s get into Talent City. Before we jump into there, so you helped create Yaba, one of the tech hubs of Lagos.

Iyinoluwa: I played a very small role.

Mark: You played a role in the creation of that. I think in some of our previous conversations, you’ve alluded to that role and that creation influencing your thought on Talent City. Walk us through what Yaba is, how you helped create the modern incarnation of it, and what you learned and what you’re taking from that experience to Talent City and what you hope Talent City can become.

Iyinoluwa: I grew up in Yaba. I went to school there. I had lots of friends in Yaba. I think that one thing that I love about Yaba is just this dynamism, it’s a very cultural place. One of the few places in Lagos with a lot of old landmarks that are still standing. It has a lot of schools, has a university, has a cultural vibe, even though it’s not been fully explored, in my opinion. I love this place. I grew up here, so I definitely love it.

Now what has happened with Yaba was when we tech folks came, we had an option between going and staying with the stuffy bankers in Victoria Island, where the rest of commerce in Lagos centers, with the traffic and attendant problems, or locating somewhere else. The leaders of the ecosystem started out with disdain. The real fathers of Yaba as an ecosystem picked the latter option to settle in this youth-friendly place, particularly because of its proximity to talent from the University of Lagos, which is just down the road.

I came into this ecosystem. I used to live right beside University of Lagos and trek all the way to Herbert Macaulay, all the way through the railways. They imagined that if they can start somewhere, you would be able to ultimately convince the government about turning this cluster into some kind of tech cluster. Now that never happened and that created a lot of problems. When I co-founded Andela, we started in Yaba, naturally, because that was the only place I knew, at CC Hub. We grew out of CC Hub. We went to another place on Herbert Macaulay, where it’s called 314 Herbert Macaulay. We grew out of that, went to PHDS States. We grew out of that, went to Fadeyi temporarily. We grew out of that. Went to another office on Herbert Macaulay.

I moved offices six times in the first year because we were growing. There was no grade A office space that we could grow into. Ultimately after I left the business, they moved to where they could accommodate that number of staff that they had, not far from Yaba. It’s just down the street, maybe another 10 minutes away, but it’s now on the outskirts towards the mainland.

Despite that, we’re taking over an existing property because of speed. We were renovating it. To make that place great, we had to spend ridiculous amounts of money and I think it cost roughly $500 per square meter. Now other businesses were coming in to Lagos, seeing the opportunity Andela had created with talent in Africa, and obviously making more rational “decisions” to locate on the island. They were paying $850 per square meter. No housing, long commutes for their staff, crazy stuff. This is what informed my thoughts about Talent City, in the sense that what would happen if you could designate a space where tech companies knew they could come and scale, right?

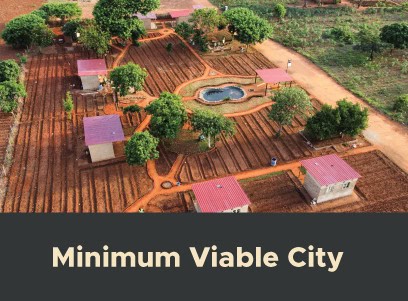

They could put your most critical engineering staff there. They could come in and scale. It had the quality of infrastructure and quality of life that tech people need to be able to function, because a lot of places outside Lagos, you don’t have those things. You don’t have those things. They have bad internet infrastructure, poor quality buildings, they’re not grade A, not enough thought put into the quality of life of the young people. How do you create activities for them? How do you make it fun? Are there young people in the vicinity that could act as some attraction, because you have to meld with society. You can’t isolate yourself. That’s a big lesson for me. You can’t isolate yourself as a city and expect to thrive. You have to merge with society in an organized way.

That’s what’s informing our design for Talent City, where we’re trying to build this charter city specifically dedicated to harnessing technical technology talent. We think it stands a better chance than many other attempts. Technical talent is famously sedentary. There’s no need for world-class transport infrastructure when you have Zoom.

I mean, it helps to have it, but people don’t leave every day. They’re not leaving town and coming back every day. Also, most people care about the company of other technologists and quality of life. Those are the most important things they care about. As a group, we’re very invested in this type of city building, especially because we want it to be a template for what other cities could look like eventually. We’ve gone very far. I was just explaining earlier, we’ve developed our city plans. We’re now go into a costing process to understand what we can do. I think the biggest benefit for businesses that are looking our way would three things.

The first is providing your employees quality of life in an amazing and serene environment, where there is a reputation for hospitableness and safety. Second of all, we’re looking at a target cost per square meter of $100 to $150 per year. That’s a far cry from what you’re typically paying in Lagos for the same quality of infrastructure. I would say the third thing is we have a big focus on identifying young people who can be trained and that will stay. You’re far away from Lagos where your talent can get poached.

Another element is the tax breaks that you can get. It’s in a free zone, so you don’t owe any corporate taxes. We have opinions from FIRS to support that. There’s a lot of benefits to being located in the zone, even for the rest of your business. These are some of the things that we are going to encourage.

Mark: Cool. One of I think challenges of any new city project is getting that initial mass of people to move. Nobody wants to be the first person to move to a city, because then there’s no grocery store, there’s no restaurant, there’s no people to date, there’s no people to hang out with. There’re no jobs. How do you get that first few thousand people to move to Talent City?

Iyinoluwa: The goal is that sometime before July, we want to put together an online showroom where people can see what their lives could look like and then start to have people apply to be invited. The idea is to build anticipation and then you admit a bunch of people at the same time. A minimum number is about a 100 people and we would post all these things that make provisions for them and then selectively start to add newer and newer and newer groups of people as we go along. That’s our strategy in that respect.

Mark: Cool. That sounds good. You’re going to open the showroom in July. When are the first residents going to move in?

Iyinoluwa: I’m really hoping we can get them in by November before the carnival season, so people can come and–

Mark: Sell them on Calabar. Move in and we can have a carnival!

Iyinoluwa: We’re going to have a carnival. The idea is that people are settled in by carnival season, then we get a lot of interest because people want to come in and visit, see what’s going on. All dependent on financing, of course, but that’s the plan.

Mark: Cool. The financing is always tricky. Charter cities are a new untested model and it’s too much like real estate for venture capitalists.

Iyinoluwa: I think that the risk is a little bit over-pronounced. I’m still looking for the right financier, I’ll tell you. I’m making some slight progress.

Mark: If you guys are listening!

Iyinoluwa: There are two categories of funding that a charter city needs, right? There is the conceptualization of the idea and the negotiation of key documents and elements with the right parties. How do you make this charter city idea more concrete? I would argue, $250K to $500K gets a decent team there in record time, identifying the land, building the plans and all that. Now project finance involved in the building of the city, I consider it to not be the responsibility of the charter city itself. I don’t think that’s sustainable for a charter city.

Mark: Who finances it?

Iyinoluwa: I think private developers will. In fact, I’m confident private developers will. If there is infrastructure and they don’t have to put their money in infrastructure, they’ll come. They’ll all come. They’ll all come. They’ll all come and build what they want to build. I think that’s really what we should be encouraging, in my opinion. There are so many great models from the way estates are developed in Nigeria. It’s just they don’t have those additional policy elements, but you have estates of hundreds of homes, or thousands of homes in a set area. That’s how it happens.

You don’t see VGC looking to build homes for people who live in VGC, or Naikon town. They don’t do that. They’re building infrastructure. They set up the place. They give you some general idea of the rules and that’s it. It’s that conceptualization and the initial acquisition of the land that there is need for charter city financing for. And perhaps the development of technology to support the new ways of doing things. I don’t think that a decent charter city project needs incredible amounts of money. If you fund a charter city project with a million dollars, which I think you can actually compound very easily, in no time, within three to five years, I think that’s enough if you’re working with a serious team.

Mark: I think that’s right. The initial funding to get the deal in place and to get the master-plan drawn up is relatively small when we think about it. It’s a standard seed in Silicon Valley. Let me ask you one final question. You’re focusing on remote work on this emerging computer, or engineering software talent. How can you take advantage of the current crisis? Then two, how do you scale that effectively? Because if we think about economic development, the countries that have gone through it recently, like China, Korea, Japan, they’ve all focused on manufacturing. How big can you build a city on remote work?

Iyinoluwa: First of all, I’m broadening a lot of my thought processes in terms of who comes to the city. I think there’s a role for manufacturing in the city, especially new and innovative kinds of manufacturing, and we have great power, we have a gas power plant. We spent considerable amount of money building a gas power plant. We know how to do it and we can power the area. I’m more confident about manufacturing and all that also coming into the zone, given its natural advantages, including the fact that it has a port right next to it.

In terms of how COVID is helping us, we’ve started to engage people and people are saying, “Look, guys. I need to get out of Lagos.” Lagos is the state with the most infections and they’ve lifted their lockdown. There’s so much going on. This is expected to continue for a while. I think there is quite a bit to learn from our users. The demand is growing, and we want to keep educating our users and learning more about them and showing them how we are an alternative for them and also start to plan for them to move in.

Once we can answer the finance question, we’ll definitely guide our team on that. I can tell you for a fact that I have technology companies already telling me that, “Once your city’s ready, if it has this level of infrastructure, I’ll move my people in day one. Chop-chop. Right now. Right now.” Because of COVID especially, because they need a place outside of Lagos where they can put all their people, continue to do essential work. And Calabar, where we’re looking at locating, interestingly enough doesn’t have a single case. It has no COVID cases. That’s an interesting opportunity for us.

Mark: Cool. Well, great. Good luck on the city and let me know when I can get a tour.

Iyinoluwa: Oh, absolutely. I’m sure by the next time you come, not for the first time, we would have a tour. I’ll send you those city plans, so you can take a look at that.

Mark: Yeah, that’d be great. Thanks for coming on the show.

Iyinoluwa: Same here. My pleasure. My pleasure.

Mark: Thank you for listening to the Charter Cities Podcast. For more information about this episode and our guest, to subscribe to the show, or to connect with the Charter Cities Institute, please visit chartercitiesinstitute.org. Follow us on social media @CCIdotCity on Twitter and Charter Cities Institute on Facebook.

I’m your host, Mark Lutter and thank you for listening to the Charter Cities Podcast.

Links Mentioned in Today’s Episode:

Charter Cities Institute on Twitter

Charter Cities Institute on Facebook

Nigerian educational attainment in the United States