For today’s episode, we discuss urban planning with Alain Bertaud, senior research scholar at NYU’s Marron Institute and the author of Order without Design: How Markets Shape Cities. Our conversation covers many subtopics under the central theme of the processes that allow cities to come into being and be maintained. Cities – healthy ones at least – are in essence the products of spontaneity, compositions of ever-changing movements dictated by the connections between the people who live in them, and we consider how planning can accommodate this reality. One of Alain’s central hypotheses is that labor markets are the foundation of cities and the idea that good transport and service-based approaches to planning will produce healthier labor markets. This idea penetrates much of the conversation with Alain today and we hear his thoughts on topics like which cities had labor markets and which didn’t, why some cities die and others keep surviving, why some shape history and others don’t, the best ancient cities, and how one might approach the construction of a master-planned city. We consider two models that mayors could follow, that of the janitor and that of the CEO, with one focusing on service and the other, a grand vision. We consider which of these two models best serve cities concerning their fundamentally spontaneous nature. Alain also weighs in on the idea of negative property rights, Haussmannian and Schumpeterian approaches to planning, and the future of transportation in relation to a city’s ability to develop organically. We wrap our conversation up with a focus on charter cities, looking at how to fill up a space that is not a destination in and of itself yet. Catch our conversation today for wide-ranging and incisive observations on the nature of cities with our wonderful guest. Links mentioned in today’s episode can be found below the transcript.

Transcript (edited for clarity):

Mark: Hello and welcome to the Charter Cities Podcast. I’m your host, Mark Lutter, the Founder and Executive Director of the Charter Cities Institute. On the Charter Cities Podcast, we illuminate the various aspects of building a charter city. From governance to urban planning, politics to finance, we hope listeners to the Charter Cities Podcast will come away with a deep understanding of charter cities, as well as the steps necessary to build them.

You can subscribe and learn more about charter cities at chartercitiesinstitute.org. Follow us on social media, @CCIdotCity on Twitter and Charter Cities Institute on Facebook. Thank you for listening.

Our guest today is Alain Bertaud. He is a Senior Research Scholar at the Marron Institute at New York University and the author of Order without Design: How Markets Shape Cities, my favorite book about urban planning.

Mark: Welcome to the show, Alain.

Alain: Thank you for inviting me.

Mark: To start, you frequently talk about cities as they were markets. What does that mean?

Alain: It means that the foundation of a city is its labor market. In an operational way, the labor market is the most important thing for the functioning of a city. “Labor market” doesn’t mean that everybody has a job. It means that it is a market, and emphasis on the word “market.” It means that workers are able to change jobs whenever they feel like it and when they feel that their welfare or interest depends on it.

At the same time, employers have a choice between a lot of workers with different skills, depending on their business. The larger the labor market is, if it works well, it creates an enormous amount of productivity and creativity. Everything we like about cities is built on this labor market. For instance, meeting friends, going to concerts, museums, restaurants, whatever we like to do in cities, is built on this labor market.

The day the labor market collapses, all of the superstructure that we enjoy in cities collapses at the same time. Detroit illustrate this case. When you have a city with only one employer, a city built by a company around a steel mill or whatever, this city is not really a labor market. Because there is only one employer, and so it doesn’t work very well. The cities of the former Soviet Union, or China before reform, were not labor markets, although they had full employment. But there was no labor market because people were employed in a factory and they would stay there all their life. They had no way of changing. That’s not a labor market. The word “market” is very important.

The other aspect of the labor market is that it implies if you want to have real choice between different jobs, depending on the evolution of your career or your interests, it means that you should be able to access any job within the metropolitan area and not just the jobs within 10 minutes’ walk or bicycling from your house. That’s the other implication, which I think enough planners do agree with. They think that through clever planning, they can match jobs and housing next to each other. This is really the destruction of a labor market.

That’s the way the Soviet Union worked. The factory added houses for their workers, which were usually, not always, but usually close the factory. That didn’t create any productivity because there was no choice. Again, it is based on the freedom to select your job and change jobs often, if necessary.

You find the notion of a labor market in Adam Smith. He mentioned the fact that you should change jobs often. The freedom of selecting your job is a basic thing about creativity and productivity.

Mark: How do you think about mega regions? There’s been a lot of discussion about mega regions, for example, the US North East from Boston, all the way down to Washington DC, or the California greater Bay Area, which isn’t really a city. It’s much larger. Do those function within the same labor market paradigm?

Alain: They should. They are fragmented labor markets next to each other. You have an advantage if you have overlapping labor markets that are fragmented. You have an advantage over a region which is much smaller, obviously. But they are not integrated. You could commute from New York to Boston maybe twice a week, but you cannot commute every day, so it’s not an integrated labor market.

In the Bay Area, like along the eastern seaboard, the cost of housing is such that it prevents people from moving around freely. Or even for moving from outside this area to a very high productivity area like the Bay Area, New York, Washington or Boston. This is where the Chinese are more advanced than us, because they have identified what they call “cluster cities,” which are cities that were not planned and spontaneously evolved around very large cities, like between Beijing and Shenzhen, in the Pearl River Delta that the Chinese now call the “Greater Bay Area,” which is a little confusing with San Francisco.

The Greater Bay Area, the Pearl River Delta, has 65 million people living there. The Chinese are developing transport systems to integrate them in one labor market. A few years ago, to go from Hong Kong to Guangzhou, it would take about three or four hours. Now you can do it in 40 minutes. This doesn’t mean that Guangzhou and Hong Kong are integrated labor market. You still have a border in between.

It means that they are going toward integration and they are very well aware of the increase in productivity that you can get by integrating those labor markets. I don’t see the same understanding in the Western world among planners. Planners still dream of a lot of villages close together where you can bicycle to work and you know your neighbors, which is not the way a modern city works.

Mark: If the West wants to compete with China, how many people should live in the San Francisco Bay Area and how do we get that outcome?

Alain: I think it’s improved transport. If you live north of the Bay, in Marin County or San Rafael,

and you find a very, very good job in Silicon Valley or San Jose, commuting would be hell. Some people do it, but it’s about two hours.

Mark: I have a friend who does that, but he rented an apartment down in South Bay, because otherwise, it’s just too long to commute.

Alain: You could conceive of a transport system where the commute would be possible. I don’t think that the traditional metro system of metro, busses, and feeder busses, corresponds to that. This is something I discuss in my book, that our traditional transport system where you either drive or you take a subway and the bus, it’s just too slow for a very large area. If you move with in Manhattan or Washington DC, the subway is fine. But increasingly in Washington, so many jobs are now dispersed in the suburbs. The subway will not get you to very many jobs.

Instead of having this dichotomy where you have either cars or transit, neither is completely efficient. Although, usually in a metropolitan area car trips are shorter than transit trips, but neither of them is very efficient. I think you will have to have a mix of modes in the same trip, like a door to station mode. Then a fast train, not with a stop every kilometer, but a stop every 5 or 6 kilometers. Because then, you would have another means of transportation which is individual, or maybe shared by two or three people, rather than a bus which is shared by 60 or 800 people, which means that the bus would be much slower.

Mark: Previously, you mentioned that company towns don’t have effective labor markets, but more broadly than that, how do you think about labor markets needing to be a market with more context within industries. For example San Francisco has tech, LA has acting, New York has finance. How do you think about the integration of specific industries with labor markets of cities?

Alain: I think that within the cities you are mentioned, it’s a bit of simplification to say that New York is finance. New York is also Broadway. New York is also high-tech. Sometimes, high tech comes directly from finance, the quant started the high-tech and then they move onto something else. I think that those large metropolitan areas, although they have a dominant theme, they have a large variety of complementary jobs which are rather independent and go each in their own direction. Wealth and productivity comes precisely from this mix of jobs.

There’s not one sector which completely dominates, although there is an image. New York has the image of Wall Street, but I am not sure now what Wall Street represents exactly, but it’s not a very large number of jobs compared to all the other sectors. Some sectors provide service to other sectors, and high tech is a good example of that. High tech serves transport like Lyft, but it also serves finance. I’m sure that Broadway is using a lot of high tech to find clients or to select musicals.

You have this spilling over of knowledge between sectors. This is very different from a city like Pittsburgh used to be, dominated by one industry.

Mark: Should mayors be CEOs or janitors?

Alain: Well, a janitor is a good CEO. What bothers me is the use of “visions” for a mayor. This means that inside the mayor’s head, there is an idea that the city should become “this.” The role of a mayor is to serve the productivity and the invention of the citizen of the city. It is not to substitute for them, to tell them what direction to go.

Again, Silicon Valley was not created by a mayor who said, “Let us develop high-tech in this area.” It was developed by the people who were living there, tinkering in their garage. Eventually, the 20 mayors in Silicon Valley managed to tax people to produce sufficient services, like garbage removal, transport, and filling potholes. They managed the area well so that it could grow, but there was no vision of a mayor there.

Sometimes when you have a mayor with a vision, sometimes it’s just a pure thing. There is no vision really. That’s not too dangerous. But I think that words are important. It creates this false idea that the mayor has to invent the city. A mayor is just there to serve it. Imagine if you have the janitor running a condominium and he decides that he would like to have a Nobel Prize winners on the top floor, and then this or that on the middle floor, and so on. Tthis would be a disaster. All the janitor is asked to do is to be sure that the elevator and heating system is working. To know when the heating system is to be replaced. This is what’s important and that’s what the mayor should do.

The mayor should be listening to his “tenants,” to the people who are there, and provide them with the infrastructure to service their sector. The Bay Area, with all the jobs created, does not have a very satisfactory transport system. I think that’s a failure of a janitor at the metropolitan scale, which does not exist. There are only a lot of very small janitors there, including the mayor of San Francisco.

Mark: What does a city without a labor market look like?

Alain: We have seen some in the Soviet Union. First, the land is frozen to its current use. Because it’s the labor market that gives value to land, when there is a lot of demand for land in an area, the value of the land goes up. This change in land value in a market economy creates changes in land use, which adapts to the new needs. If you look at Moscow or St. Petersburg in the 90s when the Soviet Union collapsed, you saw industrial areas very close to the city that were possibly created even before the Soviet revolution. They’re still there.

They were 19th century factories located very close to the city center. In Moscow, more than 35% of the land was used by factories. Many of them were 19th century factories, still there, served by the subway, despite having very limited employment. You have no recycling of land in a city without a market economy. If the labor market is missing, the land market is also probably missing. Those things go together. You have a city which is frozen in time. This was the case in Soviet cities and in Chinese cities before Deng Xiaoping’s reforms.

Mark: In 2050, 30 years from now, how will cities be different?

Alain: I don’t know.

Mark: Make a guess.

Alain: I’m sure they will be very different, unless we screw up completely. If they are not different, it means that we are frozen in time like the Soviet Union.

Mark: Let me break the question down a little bit more. I interpret one of your main hypotheses as being: “labor markets are important and transportation is crucial for labor markets.” You can look at labor markets function differently if they’re dependent on cars, public transportation, or human powered traffic. If we think about 2050, there’s several technologies that might have an effect on transportation abilities. The main technologies include the Hyperloop and increased supersonic travel. We already have scooters and autonomous vehicles, and also virtual reality. VR might allow for labor markets to exist without being in person.

Alain: Absolutely. I think you have to see all these things working together. There is no silver bullet. An electric scooter will not change transportation alone, but the electric scooter could be a component of the change together with Hyperloop. Tunneling being much, much cheaper than it used to be. Although when you look at the recent tunneling in New York, you will not believe it. It’s not a technological issue. It’s something else.

Mark: Why is New York so bad at digging tunnels?

Alain: Well, I have a colleague at the Marron Institute, who is spending six months trying to find out why. It’s absurd that tunneling in New York costs about 20 times what it costs in Singapore. For the first time in a hundred years, urban transport technology is changing. The subway, the buses, and the cars have been the main means of transport in urban areas over the last hundred years, with few changes.

The subway and the cars are a little better, more comfortable, more reliable, but basically, they are the same. The cars we are using now are not very different from the cars 40 year ago. We now have the sharing technology, the ability to request a vehicle on demand. And we have enough data about demand, about shifting demand during the day, so that vehicles can be put in the right place at the right time. This is completely new and will completely revolutionize transport.

This will allow for a larger labor market, rather than a more fragmented one. Right now, because of the coronavirus, all of us are working online. There is a temptation to say, “Well, this is it. This leads to the death of the city. We don’t need cities anymore.” I could be on a mountaintop in Colorado and it will be nicer than to be in New Jersey and I could do my job there. I don’t quite believe it.

I think the Internet is wonderful. You need face-to-face contact and you need randomness. A large city like San Francisco, New York, or Washington gives you the opportunity to meet people randomly that you otherwise would not have met. That’s where the spark of a city comes from. I think that we still need face-to-face contact. I saw this myself when I moved from Washington to New Jersey. I had access to everything I wanted through the Internet for my job as an international consultant.

I still felt the need for face-to-face contact. When Paul Romer asked me to join the Marron Institute my productivity jumped. I would not have finished my book if I didn’t have face-to-face contact with my colleagues at the Marron Institute.

Mark: I think that’s right. Even with the importance of face-to-face contact on the margin, presumably coronavirus might change some human behavior?

Alain: Yes, it’s possible. I don’t know how. For instance, they’re saying that New York has been hit particularly hard because of its high density. It’s true. But it was also true in the 19th century where there was a cholera epidemic in London. But this is temporary.

Density is here for a good reason. Don’t forget that density is not invented by planners. Density is produced by markets. No planners ever planned the density of Manhattan. It’s just the demand for land and housing in Manhattan that created the density.

Mark: How can cities become more amenable to children and families?

Alain: Affordability and transport. If you have a long commute, this is certainly not good for your family. The question is not how to shorten distance, but to increase speed. This is where I disagree with some of my planner colleagues who think that it’s possible to shorten distance in a large labor market. I think that the important thing is to have higher speed.

In my book I discuss the case of a woman in South Africa who has a family and she has a two and a half hour commute one way to get to her job. This destroys the family. Imagine five hours commuting. She works eight hours a day and she has five hours to commute. There is no way to spend any time with your family. I think that transport is very important.

Then affordability. I put emphasis on mobility, but we have to review our regulation in its entirety to allow affordability. Households, whether they are households of one person, or households with five members, must select where they want to live and how much land and floor space they want to consume. This should be left to the consumer. Too often now, planners try to substitute for the consumer and say, “Well, here we will allow apartments of 60 square meters or 80 square meters.” I think this should be left to the consumer entirely. It should not be regulated.

I’m not against all regulation. Fire regulation is absolutely essential, because the consumer cannot select the fire regulation they want. They do not have the expertise. I think the consumer in a particular household, especially households with families, are quite able to realize the trade-offs they want to make between distance to work, area of floor space consumed, and area of land consumed. That should be left to the consumer entirely.

Mark: What ancient culture built the best cities?

Alain: Maybe I’m biased because I’m a European. I would say Italians.

Mark: The Italians?

Alain: Yes. Yes.

Mark: The Romans?

Alain: Yes. In Rome at its peak it had more than a million people was probably not very comfortable for many of them. However, the people voted with their feet. There was a number of slaves too in Rome and the Philistines vote. I think if you look at Italian cities now, some are better managed than others. Milan is well managed. Naples is not so well managed, but both of them are wonderful cities to live and work in.

I’m biased. I’m sure a lot of people around the world would prefer to live in Houston than in Milan. This is the beauty of the human race, that we have very different tastes and values. I think I believe that the market is there to accommodate those values whenever they change. I can understand very well why some people would prefer to live in Houston than in New York. It’s not my preference personally, but I can understand why.

We should accommodate that. That’s a problem with urban planners. Sometimes they project their own preferences on the citizens of a city. This should be avoided completely. We are technicians. We are not gods. We are not looking for followers.

Mark: Was Haussmann a positive or negative influence on Paris?

Alain: Positive of course. It’s difficult to think that Paris would have survived very long with its medieval design. Again, this is an idea I developed, that the city is grassroots-driven. The market is grassroots-driven. People invent things, they build things, and technology changes. As soon as a city becomes rather large, let’s say more than a million people, you need a top-down decision for infrastructure which will link the different neighborhood together. Haussmann did that. It was a little brutal, but it worked.

One motivation was the military. Parisians say that they’ve loved street riots since the French Revolution. Napoleon III was concerned about this, so there was a military purpose, but there was also definitely the idea that in the labor market, you should be able to move from the eastern part of Paris to the western part of Paris in a relatively short time.

You could not do it with medieval streets, most of which were 5 or 6 meters wide. You see those streets in the Marais or in the Latin Quarter, which are very nice, but the complement to these small streets is the network that Haussmann put on top of it, and it’s worked very well. The motivations of Haussmann are not important. What’s important are the outcomes.

Mark: Some cities historically had been responsible for this great human flourishing, for example, Athens and Vienna. Why did that happen in those areas? Is there a huge inequality in terms of cultural capacity in certain cities? At its peak, ancient Athens was what, 40,000, 50,000 people? What leads to this huge difference in cultural productive capacity and what can we learn from that?

Alain: It’s difficult to know why Athens and not any other city. Athens was at the hub of a network of Greek cities which all were intellectually flourishing. Pythagoras was not in Athens. Thales, a mathematician, was not in Athens. It was a network of trading cities.

Athens was at the center of the earth in a certain way. Why Athens rather than Babylon, for instance? I don’t know. Athens was not a very large city, 50,000 people at it’s peak. It’s amazing to see that a 50,000-person city could influence an entire civilization for 2,000 years. That’s a mystery.

It’s clear that people met there and there was freedom to exchange ideas. I think that maybe it was the freedom within the city. It was not the size of the city. It was the freedom within the city and why the Greeks invented freedom. If you compare to the cities of the Middle East, which were dominated by the Persians at the time, there was no freedom. It was a very, very, very well–organized kingdom, but there was no freedom. It was an absolute ruler.

It’s the same with the Italian cities. The Italian cities were really merchant cities. The most prosperous was Venice, which was a merchant republic. There was a study about medieval cities in Europe, called princes and merchants. They found that the cities which were dominated with merchants produce far more artists, writers, and scientists than cities which were dominated by a very strong ruler, a prince. There is no commerce without some freedom. Even if you have an oligarchy, you need some freedom for commerce. I think that commerce creates liberty.

A painter like Titian, the Venetian painter. His main client was Charles V in Madrid. Charles V asked him to come to Madrid all the time because he gave him a lot of work. Titian decided to stay in Venice because of freedom. He said, “I have my friends here. I can say what I want in Venice. I can write what I want. If I go to Madrid, there would be the Inquisition. I may get into trouble. I like freedom. It’s not only venting. I like to discuss with my friends.” Only in Venice did he have this liberty.

Galileo was free when he was in Florence. When he moved to Rome, he got in trouble with the Inquisition. Because the pope is in Rome, there was much less freedom than they had in Florence. Florence was a merchant city.

Mark: The five boroughs of New York formed modern-day New York City in 1897. What was that process like and is that a model for other places like the greater Bay Area in and around San Francisco?

Alain: Yes. I think that the five boroughs are not enough. I think it’s unfortunate in New York that we have divisions not only between cities and towns, but also between states. Three states that create dysfunctionality. I think there should be an authority, probably a political authority, using the labor market to establish the boundary.

This is what the Census Bureau is doing when they talk about MSAs to define the agglomeration. When the Census talks about New York, they are talking about 20 million people, which is the labor market of New York. I think that there should be an authority there to coordinate top down things like transport infrastructure. I’m not sure if this is compatible with the American Constitution, but this is happening in Europe. For instance, in the Paris region, they say Isle de France, which is an elected political authority. This authority has a regional view and coordinates infrastructure with Paris and the 2,000 municipalities in the Paris suburbs.

The authority coordinates investment in subways, but also in things like storm drainage and pollution. It’s a little dangerous that this could become a technocratic thing which becomes political at the same time. But this is beyond my capability to forecast. The Chinese have one big advantage, and it’s not that they have an authoritarian government. It’s that their city boundaries are located very far away in the suburbs.

They can coordinate investment in infrastructure extremely well. If you look at the infrastructure investment in the Pearl River Delta, it’s extremely impressive. It serves many different municipalities and counties and go even crosses political boundaries into Hong Kong and Macau.

Mark: In the 1850s and 60s, central Chicago raised itself up 5 or 6 feet. They just put all these buildings on widgets. What cities could do that today and how do we rediscover that spirit of being able to lift a city off the ground in the US?

Alain: I think that this is a wonderful question. Because I think this is a major stumbling block. We have a reduction of property rights within your own property, but you have an extension of your property rights outward in exchange for losing your property rights within your property. For instance, planners can say that you cannot have a bakery on your plot or that you cannot build more than five-stories. You have a reduction of your property right, but in exchange, you can expand your property rights, or at least veto the property rights of your neighbors, even within 5 or 6 kilometers of your property.

It’s a dilution of property rights. You lose your own property right, but you expand your property right among your neighbors, but this expanded property right is not very constructive. It’s only a veto power. If somebody wants to build a tower 500 meters from your apartment, you can prevent them from doing it. This system creates paralysis. If you have diluted property rights, there’s no action possible. Somebody will always veto something.

I think in all our Western democracies, we have this problem. We have to go back to property rights which are restricted to you own property. There’s a recent case in in New York. It’s a tower called 200 Amsterdam.

Mark: The judge is requiring that they’d cut off the top.

Alain: Cut off 20 floors. The building permit was obtained completely legally, there was no hanky-panky. It’s just that a group of citizens decided that they didn’t like this tower and the judge said, “Indeed, it doesn’t look like the rest of the neighborhood. Therefore, take off 20 floors.” That’s a decrease in property rights, which makes it nearly impossible to do anything. I hope they appeal. Property rights are very important.

Mark: I’ve written on that a little bit, the tragedy of the anti-commons. This paper was written after the fall of the Soviet Union and the guy wondered, “Okay, why are all of the storefronts closed, but there’s always kiosks that are full of goods?” It’s because within the storefront, there were five different people who could say, “No, I was the property owner.” There were four other regulators. You had to get yeses from all of them.

We’ve turned a lot of society into having this tragedy of the anti-commons, in that there’s so many people who can say no, it effectively prevents anything from getting done because there’s so many different roadblocks that coordination effectively becomes impossible. What has China done right and wrong with urbanization?

Alain: I think that at the local level, the Chinese mayors are very good janitors. They were a little late to take care of the environment, but now they are doing it and that’s being done at the local level. They have done a lot of things right. In China, it’s still a dichotomy between central planning and local planning. Local planning really reflects markets, but sometimes they introduce measure from central planning in the middle of it.

They go back and forth on it. I think that at the local level, many mayors in China that I’ve had contact with understand markets and land value much better than European or American mayors. I’m surprised to say that. You still have a command economy from time to time, now censorship is happening more and more in China. This is the command economy coming back. It is not imposed at the local level.

There is a strong movement in universities, even with the deans, to give as much freedom as possible. They understand that innovation will come from freedom, but the central powers feel that keeping control is more important than productivity. They have this problem of the central government, although they lip service markets from time to time, markets are really well-understood at the local level and they have good local technicians. They have very good municipal engineers, so they are good janitors.

Mark: How do you make informal economies in emerging markets legible?

Alain: The informal economy exists because there is too much cumbersome regulation. Let’s talk about the informal economy in housing, in settlements and slums. Those informal settlements are there because the land use regulation does not allow someone at their level of income to have a legal house, so this informal economy is created. It should be integrated as much as possible by first understanding why some people prefer to be informal rather than formal. Others are forced to be informal.

We have to understand that there is no reason why there should be an informal economy. Everything should be formal in the sense that it is legal. I think a good example of success in integrating the informal economy is in the large states of Indonesia, Jakarta, Surabaya. There they decided that the informal village, which had been absorbed by the city, would keep their status and be able to decide about their own standards, rather than having the city standards imposed on them. And it’s become complete legal, although nobody has building permits there. Nobody has even has a formal title. This worked very well. It has been implemented over a period now of 35 years.

In Jakarta, there’s a very slight discount on informal titles compared to a formal titles, which means that the informal economy has been entirely absorbed by the formal economy. That’s a good thing. It should not be absorbed by over-regulating it. It should be absorbed by recognizing the constraints of small enterprises of poor people who cannot afford the minimum standards.

Mark: Going back to a previous thread, you mentioned Detroit and how sometimes in single industry cities, if that industry goes away, then a lot of things collapse afterwards. What are some examples? A lot of cities emerge because of an economic reason. Maybe it’s a port or a mine. But over time, the mine might dry up. If there’s a sufficient locus of activity, then the city continues. What cities have successfully transitioned from different eras and what cities have not? And what can we think about as we move forward and as the economy continues to evolve?

Alain: New York is a good example. It became very successful compared to Baltimore, Philadelphia, or Boston, which were also very big ports, because of the Erie Canal. It was an accident of topography. It became dominant because of that. However, the port activity certainly generated other activity, which then became much more important than the port itself. That was the success of New York.

In the case of Detroit, it’s not so much that their main industry disappeared or shrunk. It’s that the city was terribly managed. A case of a bad janitor. If you look at the areas around Detroit, they have not suffered economically as much as Detroit.

It’s a question of bad management. We also have to recognize that some cities were located for certain things. Let’s take the cities of the ancient Silk Road, Tashkent or Samarkand. They were on the main trade route between Asia and Europe and they succeeded. Suddenly, this trade route became irrelevant. The sea route was much more useful. They disappeared.

In this case, there’s not much they can do about it, unless the Chinese are successful in putting a new infrastructure which will compete with the sea trade route. If they don’t, I think the best thing for people of Samarkand is just to move to more successful cities, and I believe that’s what they did.

Cities are alive. Some die and some prolong their lives, but cities are not eternal. If you look at the map of Europe in the beginning of the Middle Ages, the most important and largest city by far was Palermo in Sicily. All the other cities, like Paris and London, were very small towns. Palermo is now a tourist destination, and we have to accept that. If you are a mayor, of course you try to find alternatives, but you have to accept it. If you are a citizen, I think moving to a more successful city is the best thing you can do. This was a success of the United States, attracting migrants from other places.

Mark: Why did you title your book after a quote from Hayek?

Alain: Because I think that the idea of a spontaneous order, it’s not produced by in nature in the sense of a rock or a tree, is important. There is no doubt that a city is built by people, but there is not a coordinating idea which really creates the city. There is a bit lengthy planning idea. Although, I recognize that for infrastructure, you need to plan it top-down.

The essence of the city is the spontaneous order which emerges that no planners can ever have enough information to really modify. This information is fragmented among all the players. Whether it’s a family who selects the best school for their children or it’s a firm selecting a location because of the skill of the workers or their customers, these decisions are very elaborate. But they are dispersed among a lot of people and no planners could ever try to comprehend them. Therefore, no planning is really possible in deciding which areas should go and should not go. It comes from the people. It’s a grassroots thing.

This idea of Hayek’s was already anticipated in the Scottish enlightenment by Adam Ferguson. To my knowledge, he was the first to identify the idea of spontaneous order. What makes me mad sometimes when I read reports from the World Bank, they talk about cities being haphazard. A city is not haphazard. Any building in a city is built because somebody invested his money there and built. There is a reason for it. It’s not haphazard at all. It appears haphazard or random to us because we have no understanding at all of the mechanisms which creates a city.

Mark: What do urban planners misunderstand about their own profession?

Alain: Not all urban planner are the same, I call myself an urbanist, but there’s no quantitative tradition in urban planning. It was always a qualitative thing because it was so difficult to collect data about cities. Then suddenly when you had the first satellites and then Google Earth and for the first time, you had the view of an entire city, including its suburbs.

Before you that, you had to make maps which were very costly. And every 20 years, you had very little idea about how the city works. I think that planners, because most of them are like myself, either architects or engineers, tend to be normative. If you are used to designing buildings, you are normative. You know the size of a bedroom because you know the size of a bed, then you know you need this much room to move around to move around the bed. A kitchen is that size because you have an oven and a refrigerator. You become very normative about what is good and what is bad.

It’s normal. It’s not bad to be normative if you build buildings. If you are normative, you conceive of the city as a very large building and that you should design it in detail. This is not true, because when you are an architect and you build a house, you have a client. This client is feeding you information. If you do things wrong, like make the kitchen too big or too small, the client can right away say “I don’t like it.” You have feedback.

If you are a planner, you have no feedback. The only feedback is the market. You have no feedback from your clients. If you decide, “I’m going to put poor people in the public housing, because it’s what’s best for them,” you have no feedback. You have the feedback from the governor or from the mayor. That’s all. Bureaucrats will say, “Yes, we could build this public housing in 10 years and it would cost that much if you did.”

You have no feedback from your real clients. That’s a danger. There are very good planners in India and many different countries that I admire who are really doing a very good job. I think they have to realize that they are here to serve the existing population. When they do something which bothered them a bit, like they built a very high or a very short building, or they spread things out in the countryside, they have to understand why. People are not stupid. They react to certain things. They react to their own problems. They have to understand why they do that.

Sometimes, it’s not very good. Like building in a flooded area. Then they have to understand why they do that and to compensate by introducing market incentives to prevent things which are not desirable.

Mark: I think that’s right. One of my formative experiences is when I was finishing graduate school and I did a little bit of consulting on a new city development in Kazakhstan. It was a lot of architects and urban planners and I realized that they conceived of a city as a thousand city blocks. They had worked on city blocks before and maybe they had done even two or three city blocks at a time, but a city in their mind is that you just take one city block and you control-C, control-V and replicate it. I was astounded because they were distinguished professors at MIT. I didn’t consider myself really an expert, but I fundamentally knew that that approach wasn’t right.

Alain: Absolutely.

Mark: There’s, depending on how you want to count, 120 or even 200 plus master planned cities being built around the world. Sometimes it’s the government doing what they did in Brasilia or Astana, and then sometimes it’s as a private developer who buys the land and then builds the city. What are these master planned cities doing right and what do they get wrong?

Alain: I think if you have an existing city, say, Mumbai or Rio de Janeiro, I don’t think a master plan is useful. I think that you should run the city again, using the example of the CEO. You have enough data about your city, you see the way your city is evolving and you are trying to serve the citizens around that evolution. Suddenly, you might have an influx of very poor people and you have to adjust accordingly.

There is no need for a master plan. The master plan is this idea that comes from viewing the city as a big building. You spend two years drawing your blueprints and then you have 10 or 15 years to build, according to the blueprint. This is good for a building. It’s not good for a city, because you don’t know what’s going to happen. The city is going to be confronted with external shocks all the time and you have to react to those shocks. Those plans things are not useful.

What is wrong with a master plan, too, is that there is an enormous preparatory effort by consultants who prepare a database that will serve as a “good housekeeping” seal for the master plan. “We have collected all this data, so we are serious.” In fact, at the end, the master plan will have nothing to do with the data collected.

You spend two years collecting data, and then the database becomes obsolete very quickly. And you have not established a system in the city to collect the data regularly. I’ve heard that when Michael Bloomberg became mayor of New York, he was absolutely astonished to realize that a lot of data was produced by the city but was never collected in a way which could be interpreted.

Mayors will then have to make decisions without really understanding what is going on. Compare this to the way a CEO makes a decision about his business, he would know exactly how many phones have been sold and how much they cost. If there’s a new product, the CEO knows if the product is doing well or not, he’s aware of that every day, week, or month. The mayor is waiting for the 10 or 20 year master plan.

If you are creating a new city, you have to establish a framework. You should not consider it a building. You should define very quickly which spaces are public and which are private so the markets can thrive. Basically, you establish the street network.

You should not agonize on the street network. I don’t think it matters very much. Manhattan’s was established by surveyors in the beginning of the 1800s, without any knowledge of the subway or anything else in the future, and did it very well. What was important for Manhattan is that they established long in advance what was going to be a street and what was going to be private. Citizen could then invest in a private lot long in advance with the security that they knew there was going to be a street or an avenue.

That’s what’s important. I think when you create a new city, the most important thing is to establish this network. Don’t agonize too much on the network, whether you want to have a grid, or diagonal, or whatever. I don’t think it’s that important. Do whatever you think is right, but establish the public/private boundaries first.

Then put some key buildings right away. You will have some government buildings. You may want to have a library. You may want to have a place to collect taxes. Put those buildings down because you need them. After that, let the market decide and see what happens and then adjust your infrastructure. Once you have the right of way, adjust your infrastructure to what the market decides.

Mark: That’s how we are generally thinking about charter cities. One of the interesting themes you’ve brought up several times is the difference between a building and the city. One of the themes that we often discuss in the office is the difference between real estate and cities. A lot of the people building new cities, they are real estate developers. They purchase as a real estate project. They think this is a shopping mall, but it’s basically a big outdoor shopping mall with some residential, some commercial, some educational establishments.

Even if they’re building for 100,000 residents, they’re still approaching it within that general framework, where what they do is provide the infrastructure, like roads, electricity, etc. They build the buildings and they sell them and then maybe they turn the project over to an HOA or something, but it doesn’t really function as a city in that sense. One of the things that I haven’t figured out how articulate right is that distinction.

Alain: I have seen that in special economic zones that I worked on in China. City government developed infrastructure, but established a much larger lot that they would give to developers. Those were too large in my opinion. I think that one way to solve this problem is to fragment property into a relatively small lots. If somebody wants to build a department store, obviously they will have to aggregate their small lots together, this each should be allowed.

The unit when you pass it on to the private sector, should be relatively small. Again, one of the big success of the Manhattan plan was that the lots were small. You could have, on the same lot, a bakery and another person doing something else. If you give a very large lot, like in those new Chinese cities, say 10 or 20 hectares, it’s too large. A developer will do a very large project, which makes sense from a developer point of view. It doesn’t make a city of it. You need this fragmentation so you have a lot of small initiatives.

Markets work well when there are a lot of players. If there are only two or three players, you have an oligarchy. You do not have a market. You see that this fragmentation is very important.

Mark: Robert Moses or Jane Jacobs?

Alain: Well, Moses did some good things, too. Caro explained, such a fantastic book, he explained what went wrong and how power got to his head. Although, I don’t think he was corrupt in the sense that his power got to his head. I’m a big admirer of Jane Jacobs and of her writing. But I can see here a bit of the negative property rights.

Mark: She’s a NIMBY.

Alain: Yes, that’s a little disturbing. It’s very much related to what we were discussing just a few minutes ago. If you have a city with a lot of small lots like Manhattan and suddenly you have a big developer, or the government gives power to a very large developer, who says, “We are going to assemble 20 blocks and consolidate them and do a fantastic mega structure there,” that’s of course completely legitimate to revolt against that.

It’s only because you are completely disturbing the entire thing. If one of your neighbors wants to do something and you don’t like it, that’s very different. You see, we get back to fragmentation. There was a case in New London, Connecticut that went to the Supreme Court, who issued a terrible judgment. Kelo versus New London, I think it was called. The mayor decided that there was some housing which, although it was not in bad shape, was not very prestigious, let’s say. He decided that if he could consolidate this area and give that to a developer, he would have a shopping mall and some commercial projects that would generate revenue for the city.

This area didn’t produce much revenue, because again, the houses were very modest. He managed to use eminent domain to expropriate this area. I think this is completely illegitimate. To use eminent domain for a road is okay. You have no choice. Or a pipeline or a railroad, you have no choice. To use eminent domain just because you prefer a different land use, I think is completely wrong and anti-democratic.

In this case, it didn’t work. Eventually, the developer went bankrupt and the land is now barren. I think I am on the Jane Jacobs side in this case. I will not be on Jane Jacobs’ side for 200 Amsterdam. That’s Jane Jacobs’ influence.

Mark: I’m a big fan of Jane Jacobs’ writing, but a lot of her community activism stuff seems to have heavily influenced the empowering local community to enforce negative property rights to effectively veto, and that’s leading to a lack of additional housing units and other commercial real estate in major cities.

I just thought about this, isn’t Robert Moses, to a certain extent, the Haussmann for New York? They basically tried to bulldoze a bunch of stuff and build massive infrastructure projects to increase the labor market.

Alain: No, not really. If you look at Robert Moses, it was really mega structure that he was putting on top of New York. There was a very interesting, but horrible, project by Paul Rudolph, who was very well known at time. He is forgotten now, but in the 60s he was considered one of the best architects in the US.

Paul Rudolph had this mega structure, which started at the Hudson and crossed over Canal Street and it’s a highway, but a mega structure built over the highway. This is terrible. Again, this mega structure, this is what destroys a city. If you look at Haussmannian houses, built on both sides of the avenues he created, Haussmann created lots and then let the market fill in the lots. He didn’t design anything.

Although it’s now called Haussmann housing, he never designed anything except the right of way. It’s very different from Moses. Don’t forget that the Haussmann roads were not the new streets, where it’s true that they were to be able to go from one part of Paris to another, but they had very wide sidewalks with shops on both sides.

The shops were created not by Haussmann, but by the market. You see, he fragmented the property along his roads. That’s what financed the roads. People were compensated. One very interesting book on Haussmann is by Zola, who would describe exactly what happened. He takes a neighborhood and he goes into the small shops on the small, damp streets. Then suddenly, you have the competition from this big department. It’s called Au Bonheur des Dames in French. If you want to learn about Haussmann, I strongly recommend this book. It’s really journalism, much more than just enough a novel.

Mark: What’s it called? We can include it in the show transcript.

Alain: It’s called, in French, the Au Bonheur des Dames. I think it’s translated into English. I’m sure you can find it on the Internet.

Mark: Zola is Z-O-L-A?

Alain: Z-O-L-A. Emile Zola. Au Bonheur des Dames literally, the happiness of women. Au Bonheur des Dames was the name of a department store created on one of Haussmann’s avenues, so it’s a name given by the novel. It’s in fact the Beaumarchais in Paris, the current department store still exists.

It’s a wonderful way of understanding. Zola is sympathetic to both sides. He’s sympathetic to the people who were in this damp space destroyed by Haussmann and had to make a new living, and also sympathetic to the new employee who was suddenly working in the department store, this modern thing at a completely different scale. He sees that as a social promotion, in particular for migrants coming from the countryside coming to work in Paris, compared to working in a small shop where you will be always a small employee. It’s an extremely well-balanced view of a Schumpeterian creative destruction. It’s a wonderful book.

Mark: Cool. What can Africa learn from Shenzhen?

Alain: I have very little experience in Africa, except North Africa and South Africa, so it’s not very representative. The few times where I worked very briefly in Africa, the low-quality of governance bothered me a lot, especially at the local level. Maybe they can bypass that problem? I understand that a city like Lagos, in spite of its infrastructure problem and bad janitor problem, has still managed to attract very creative entrepreneurs. I don’t like to speak about things I don’t know. Because I have so little experience in Africa really, I would not give an opinion.

Mark: I think the point about governance is an important one and that’s what we’re hoping to solve with charter cities, the idea that if you’re developing new cities, it’s possible to get some governance reforms that might not otherwise be politically feasible that can allow for a government that is more responsive to the needs of both the people and the businesses.

During your conversation with Tyler, you mentioned that you didn’t think there were any good locations for charter cities anymore. Why not?

Alain: I was reacting to Paul Romer’s assertion at the time, that he could build 50 charter cities very quickly. Location is important for a city. A city is not just good sewers and roads and asphalt. Cities are people. You have to have a location that attracts people. People are not moving to a place just because there is a sewer and a subway system. They move to a place because jobs are created there. The entrepreneur has the same idea. Why should an entrepreneur move to a new city in the middle of nowhere just because taxes are lower and things like that? That’s not enough. Location is very important, I think.

Are there any locations left? There are many good locations left. However, it’s possible that next to a city, like Lagos, you could piggyback something different on the existing city. You will have the advantage of being next to Lagos, so that the people moving to your new city will not have to risk moving to the middle of nowhere. They still can commute there, if there’s a risk. That would be possible. Or if you are in the middle of nowhere, it has to have some locational advantage.

Let’s consider Dubai, for instance. How was Dubai created? Dubai existed a long time, but it was a very tiny little city, mostly fishers. There was little trade. The opportunity came really with the Islamic Revolution terror. People forget that at the time of the Shah, the planes going from Europe, to Asia, to India, or the rest of Asia, had to refuel in Tehran. They could not fly directly from Paris or London to Delhi. They had to refuel in Tehran.

Tehran was a very important place to stop. Suddenly, you have the Islamic Revolution. Tehran now has become very difficult to do any business, so the refueling moved to Dubai because it was the right location. Now the genius of the people in Dubai was to realize this new locational advantage. They transformed it into not only being a refueling place, which after some time would no longer be needed as you could fly directly from Europe, but they made it into a free zone and it attracted a lot of business, because of good governance within an enclave.

That’s their Shenzhen lesson. Within the perimeter, you really change the rules, make them transparent, and they work well. Suddenly, Dubai became attractive in itself. Beirut was a financial center of the Middle East and suddenly it moved to Dubai because of the civil war in Beirut. Dubai used regional geopolitics. Dubai had no competitive advantage for a long time, only gaining it because there was revolution in Iran and a civil war in Beirut.

They were smart enough to capitalize on that. It was not evident at the time. You could imagine that there would be such a bad governance that the Middle East would not have a financial center, it’s quite possible.

Mark: That’s a conversation we sometimes have in the office. There’s been this, at least in some of the techno-libertarian tradition, idea that if we just get governance right, everything else follows. But in practice, if you build a city in Antarctica, nobody’s going to want to move to Antarctica, even if it has the best rules in the world and the best subway system in the world. We typically think about building charter cities as satellite cities.

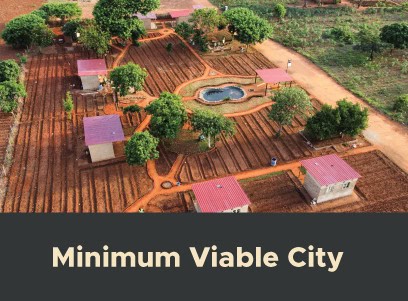

One of the new cities we’re working with in Zambia is a satellite city outside of Lusaka being built for 100,000 residents. They can access the labor market of Lusaka, but then there is the possibility of these true greenfield cities in the middle of nowhere. Typically, a challenge that you rightly point out is that getting the first people to move there. Nobody wants to, even if you’ve got very nice amenities, Typically, the way we think about solving this is attracting an anchor tenant.

You build a small port, you build electricity, roads, sewers, water, etc. But then you need somebody to come in and create the first 1,000 jobs. With the first 1,000 jobs, then you have a small supermarket, then you have a restaurant, and then there’s enough economic activity that additional people move. This is the model that shopping malls use. They typically charge a lower cost per square foot to department stores than to the food court or to the jewelry shops. That’s the theoretical strategy behind the approach that we’re taking.

Alain: The question is why your anchor tenants will go to a place where there is no labor? They would have to bring their own labor. Then there is this cash flow problem for a city in the middle of nowhere. You need an airport, an international airport. This is an enormous upfront cost that you’ll have to carry. When the city is still small, you have to pay for this damn airport. It’s a cash flow problem.

That’s why I think the cities in the middle of nowhere that have been called successful, are usually capitals. The government taxes the citizens of an entire country, like Brazil, or Myanmar, in order to create a new city. You don’t have a cash flow problemif the government is paying the bill, with taxpayers of entire countries paying for it.

Mark: I sometimes joke that there’s three ways to build a city. There can be an economic reason, in which case people move there naturally. You can be a government, in which case you can force all your bureaucrats to move. Or you can start a religion, which is Salt Lake City.

Alain: Right. Yes.

Mark: I think that’s right. I’m not sure you need a major international airport. It depends on what your initial goals for the city are, how you stage it. At a later stage, 20 or 30 years in, you want might want a major international airport. To start, your five-year goal might be 50,000 residents. If there is a large enough population in the surrounding region that you can draw from in towns of 50,000 people, then you might be able to get them to relocate for the early stage challenge.

Alain: It depends who you enter and got financiers. Yeah. If you are thinking of high-tech, an international airport seems to be indispensable.

Mark: Our general assumption is that you’ll get a few high-tech cities. You can think of charter cities as Dubai clones versus Shenzhen clones, where Dubai basically imported a bunch of high human capital labor from Europe, and so they needed to be very high tech. Then Shenzhen started off with textile manufacturing, doing very low productivity, high units of labor activities and then worked its way up the value chain.

While there’s going to be a few Dubai clones, I expect if you get a dozen charter ciites, nine of them or more are going to be focused on manufacturing just because that’s where a lot of the value add is. You can draw out farmers from the countryside who don’t have a lot of skills to man the factories.

Alain: Yeah, it’s true. If you look at the way Dakar, or even Delhi, has grown, they have expanded by starting a few factories far out. Then this grew into labor intensive factories, textiles or something else. Then a little town grew around it, but unfortunately without very good governance.

I remember in Dakar some years ago, a six story textile factory collapsed. I looked at its location on Google Earth and it was nearly 60 kilometers from Dakar. It was pretty far away and I was wondering why would you would build a five story factory 60 kilometers from Dakar. It just shows how there was a demand for it and it’s interesting how these things grow. If you located a charter city there, it probably would have worked.

Mark: For the last question, one of the things I have been thinking about doing at the Charter Cities Institute is a model urban plan inspired by the Garden Cities movement. The idea being a city of 10,000 acres, two-thirds the size of Manhattan, a million people over 30 years, per capita income at about $1,500 a year, which is the median in a lot of African countries.

Obviously, you can’t replicate this one to one, but it hopefully would serve as an inspiration. It would allow for travel anywhere within the city within 45 minutes using public transportation. We want to develop this really clear model that hopefully can be used as a reference point for people in the future doing charter cities. It feels a little bit like this might over-planning, but I want to get your perspective on that idea as a work product and whether you think that would be useful.

Alain: Yes. If you’re planning a city, what you plan is the right of way through a street network and some basic civic buildings that you want to build at the beginning in order to make it a city and not just a suburb, I think that’s completely legitimate. In your transport system, I would give a good space to individual transport like electrical scooters and things like that, which I think which are a very good way to move around and do not require extensive management of a network or a very expensive cash flow. Even the bus system to be efficient in a large area requires a lot of investment and management.

The trend in many Asian cities is that the motorcycle is really the main mode of transportation. The problem with motorcycles are noise and pollution. You could probably have a very competitive electric motorcycle, which go about the same speed, but generate less pollution and are safer. I would include that as a component of the transport.

Although when you have enough density, you may want to have a bus system, but perhaps only two or three lines, not an extensive system. You need very clear property rights in your regulations governing the way people can build or not build.

Mark: Build whatever you want.

Alain: Okay. For me, they let a smelter in the middle of the city.

Mark: That’s all of my questions. Thanks for coming on the show, Alain.

Alain: Thank you, Mark. Thank you. It was a pleasure.

Mark: Thank you for listening to the Charter Cities Podcast. For more information about this episode and our guest, to subscribe to the show, or to connect with the Charter Cities Institute, please visit chartercitiesinstitute.org. Follow us on social media @CCIdotCity on Twitter and Charter Cities Institute on Facebook. I’m your host, Mark Lutter and thank you for listening to the Charter Cities Podcast.

Links Mentioned in Today’s Episode:

Order without Design: How Markets Shape Cities