What does it take to achieve rapid industrialization in a charter city? I think the answer is that charter cities will need to have teams of people specifically dedicated to attracting industrial investment. To carry out this function, an investment team would require a mixture of a marketing team, an internal policy think tank, an “air traffic controller” for internal policy decisions across the city government and a venture capital fund.

The important question is why such a team is needed in the first place. If the charter city’s fundamentals—rule of law, infrastructure, human capital—are optimized, won’t investments flow in? In most cases, the answer is no (or, if left to emergent forces alone, it often takes a very long time). So there is still a great amount of benefit in trying to speed up this process.

Imperfect Information Markets

There are two problems with the idea that strong fundamentals are sufficient in attracting investment. The first is that the market for information is imperfect—especially in low- or lower-middle-income settings. Corporate investors frequently make decisions with imperfect information. They don’t know how good local roads are unless they visit, they don’t know the quality of local talent until they hire staff, and, most importantly of all, they don’t know how committed the charter city team is to economic growth until the investment happens. Should a charter city decide to not have a team to attract investments, it is inevitable that other people will write the city’s narrative. No matter how good the charter city’s fundamental attributes are, what will make or break its economic success is how well it is marketed to potential investors, business tenants, and clients.

The second problem with corporate decision-making is also related to information: even if corporate investors have the information, they do not have the luxury of infinite time to dwell on their decision. It is more likely that their decision will be influenced by marketing, and will deviate from fundamentals on the ground. This is further compounded when investing abroad under serious time pressures. Many companies make foreign investments as a defensive measure, as they don’t want their rivals to capture a market first. Or the investment will be made because the company is facing cost pressures in their current locations and need to shift abroad before their products are priced out of the market.

For both of these reasons, it is unreasonable to imagine that these decisions will be made like the rational agents of an economics textbook. It is more likely that they will be made with imperfect information under time constraints. This dilemma was best summarized by Singaporean Prime Minister Lee Hsien Loong in 1991 (then a Brigadier-General, Deputy Prime Minister, and Minister for Trade and Industry):

“A free market economist may query whether the EDB (Economic Development Board) played any essential role in [Singapore’s] unquestionably dramatic transformation. He could argue that the transformation would have taken place anyway, as it was the attractiveness of the Singapore business environment, not the persuasive powers of EDB salesmen, which determined whether investors came to Singapore.

This line of argument over-simplifies reality. Following its logic, most companies would not need marketing and sales departments. The intrinsic merit of their products would sell themselves. This is simply not so. The argument overlooks two key elements. The first…is that in real life MNCs (multinational corporations) have to decide on investment projects under time pressure and given only partial information. This gives EDB a window of opportunity to present Singapore’s case and swing projects to Singapore. EDB’s high standard of professionalism, dedication, and job knowledge in these project negotiations has been a crucial competitive advantage. Without the EDB, some investments would still have come to Singapore. But many more would not even have considered Singapore, or been aware of what Singapore had to offer.”

These imperfections will create opportunities for a competent charter city investment team to correct market failures and successfully attract investments.

Functions of the investment team

The Faster, the Better

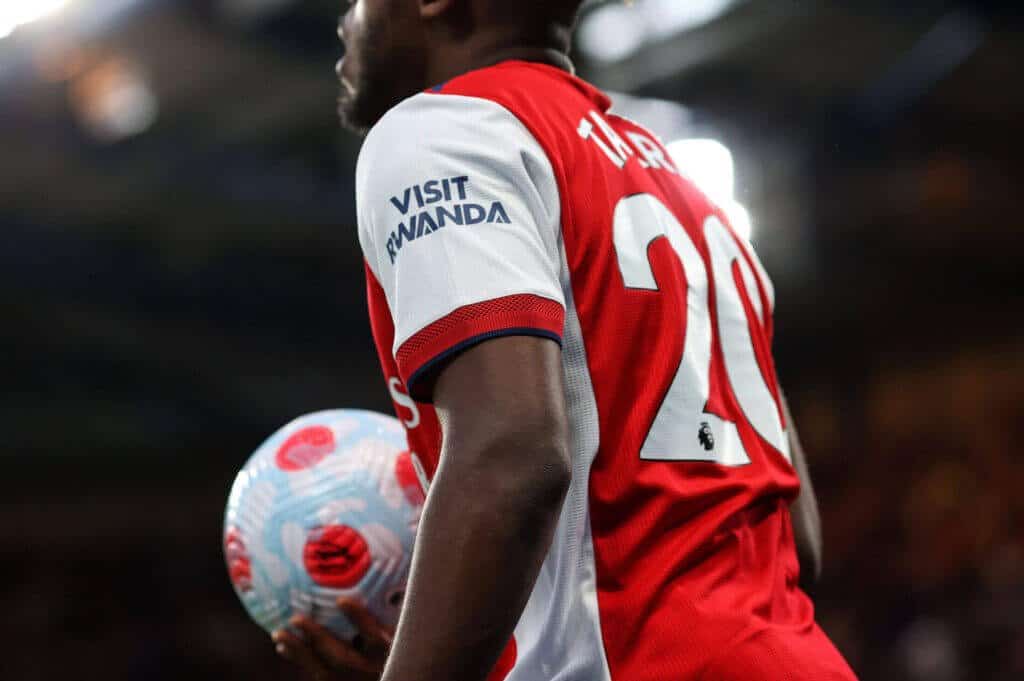

One obvious function of the investment team is to market the charter city to foreign executives. Existing investment development boards have a similar remit that charter city investment teams can learn from. Many of these investment development authorities have offices abroad, and they organize summits, conferences, and investor meetings at home and abroad in order to attract the attention of large companies. Enterprising local officials, like Miami Mayor Francis Suarez, use Twitter to attract investors. Rwanda’s government famously advertises on the jersey of Arsenal FC.

But marketing is just the first step in attracting investments. What matters then is the speed of execution. As described earlier, the speed at which companies can set up business is crucial to their operations. The next step for the investment team is to ensure that whatever the investors need is speedily provided. A good example of this can be found in China in the late 1990s and early 2000s, when local governments competed for investments, and in the process endeavored to make investing in an industrial park extremely easy. Ronald Coase and Ning Wang write in How China Became Capitalist (p. 142):

“It [the industrial park] provides all the governmental services needed for a business to open and operate, including registration, permits, and regulations. Instead of running from one government office to another to obtain various permits, the business in the industrial park can get everything they need in one place. The second office is non-governmental. Often called the Industrial Park Management Committee, it looks after the daily operation of the park and provides administrative services to all the resident firms.

The relation of the park management office and firms is like that of a service provider and its clients and bears little resemblance to the constricting bureaucratic relationship between the supervising authority and state enterprises.

Rather than passively waiting for investment, the local government reaches out to invite or solicit business. From the perspective of a businessman looking for a place to locate his firm, a key concern is the local business environment, including the efficiency of government services and access to the inputs required for his operation.”

This model is now commonplace among special economic zones across the world, where there is a one-stop shop for interfacing with the local government.

Another example is the Subic Bay Special Economic Zone in the Philippines, which was converted from a US military base to a special economic zone. The Subic Bay Authority made some crucial decisions to make the new SEZ attractive: they had a one-stop shop for investors to interact with the Authority, they allowed local governments to become a part of the SEZ if they chose to do so, and took advantage of existing base infrastructure to save money on capital investment. The transition was very rapid: within four years there were over 150 companies and $1.5 billion invested in the zone.

The same sentiment is echoed by Lee Hsieng Loong in the same speech from above:

“One example was the first Texas Instruments project in 1968. TI knew very little about Singapore. It was not sure whether Singaporean workers had the skills and discipline necessary to work on an electronic assembly line. EDB took the TI team to a hair wig factory to show them the girls patiently stitching hairs one by one onto wigs. TI was convinced. Its project got off the ground within 50 days flat, from date of project commitment to the production of the first batch of semiconductors and integrated circuits in Singapore.” [emphasis added]

Thinking and doing

It is important for small factories, like those engaged in low-value electronics assembly, that they are constructed quickly. This is partly because these businesses do not need much government approval or other state involvement to launch the project. Most of the logistics can be handled by existing sea and airports, training workers is not very complicated, and the financing is simple. For small-scale, low-value products, there is very little government involvement needed.

One good example is the Hawassa Industrial Park in Ethiopia, where the government has built the necessary infrastructure for manufacturers to start operations. They can “plug and play” in the factory sheds which makes it extremely easy for manufacturers to enter, and increases investments.

But what happens for more complex products where more supporting infrastructure is needed?

Take, for example, the development of an industry that manufactures and assembles high-value products like automobiles. Such an industry would need to be of a much larger scale, in physical terms, than low-value electronics assembly, and would present new challenges for the charter city government. First, the infrastructural challenges would be very large. Such a factory would need a large area of land, cheap and reliable electricity and water, ports to import parts and export finished goods, and road/rail links to those ports. And on top of all of this, there would be other governance challenges. How would the city regulate pollution created by the industry? How would the city ensure there is adequate housing, transportation, and so on for the workers?

Building the needed physical environment for any high-value product would require coordination across multiple government departments and agencies. It would require large amounts of financing from the government and it would necessitate attracting many multiples of pre-existing investment levels. It would also be important to coordinate with the private sector in this process. Not only is it important to understand their needs, but they could also play a part in financing the infrastructure that will be used.

And the more advanced the target sector (e.g., software or biotech) the more complex the undertaking. Should the charter city project want to develop research and development clusters like Biopolis and Fusionopolis in Singapore, this would require a lot of effort by the government. It would take the development of an ecosystem of institutions. Having one large factory or investor isn’t enough, there would need to be multiple of each from multiple industries. A biotech cluster like that of Boston would need universities, some anchor companies (like Biogen was), venture capitalists, and the talent required to build it.

This would be a Herculean task for any government, let alone a charter city. It would require years, if not decades, of investment, tens of billions of dollars in capital, a regulatory apparatus among the best in the world, and, more importantly, the ability to coordinate the government across departments and across time.

But there will be multiple such demands on the government. One idea might be cars (like this in Morocco), but the other might be advanced technology or shipping. How does the government then prioritize?

My answer to these challenges is that the investment team should be responsible for triaging policy ideas and has the responsibility of working through the internal bureaucracy and getting the necessary reforms done. Investment teams are uniquely poised to understand not only the industry they wish to attract but the local context into which investors will enter.

If a government wants to move its economy up the value chain, it will need to have multiple changes in not only economic policy but also in policy across various sectors. A shift towards high-value semiconductor manufacturing will not only need subsidies, it will also need infrastructure investment and changes in the education system.

One important part of this process is knowing what changes need to be made to attract investors. This is the part where investment teams are likely to shine. The next part of the process is implementing those changes. That is best left to experts in those specific sectors. But in between all of these, there needs to be someone directing the policy changes, deciding what comes first, second, third, and so on. I’m proposing that the investment team becomes the traffic police of policy change: based on their intimate knowledge of and interactions with investors, the investment team is in a good position to recommend what various departments should prioritize and help to internally coordinate the whole-of-government response.

The idea of having an internal coordinator is not new. Some examples are the President’s Delivery Unit (PDU) in Indonesia, Kenya, Liberia, and even in the US for action against AIDS. Liberia’s PDU, for example, was a single office responsible for implementing infrastructure projects that the President wanted completed. To quote from former PDU Head W. Gyude Moore’s biography:

“As Head of the PDU, his team monitored progress and drove delivery of the Public Sector Investment Program of Liberia—a program of over $1 billion in road, power, port infrastructure, and social programs in Liberia after the civil war. As one of the President’s trusted advisors, he also played a crucial role in supporting President Sirleaf as Liberia responded to the West Africa Ebola outbreak and shaped its post-Ebola outlook.”

One good example of what happens when this traffic direction does not occur is from General Peter Pace, who claimed that the chaos of the American federal government bureaucracy was insurmountable in getting anything done. The problem he says (via this blog post), is that there is nobody to coordinate people in the federal national security bureaucracy:

“The problem is that nobody below the President has the authority to direct traffic. The military commander in the joint command can give orders. The President can give orders. But once he says “this is what I want to do”, then the good Americans who are State, Defense, Treasury, go back to their offices, their buildings, and they start operating and executing their piece of the problem.

State’s approach is different from DoD’s approach, is different from Treasury’s approach, and there comes a time when the approaches taken by the various agencies and departments start to have friction because they have different responsibilities. Because nobody below the President has the authority to direct traffic and because only if one of those Secretaries brings it to the President’s attention for him to make a decision—if they don’t do that, which most strong people don’t, then you have friction that goes on below the President’s knowledge.”

Why the Investment Team for Traffic Police?

First, because it is the investment team that has the closest grip on what investors want, and how the market is evolving. This team is, after all, in contact with people from across the world, has contacts in industry, and is home to more practical business knowledge than most people in the charter city government.

Second, because the investment team would have a strong interest in pushing policy changes throughout the government. Personally, investment team officers are the ones most likely to see benefits from completed reforms. If, for example, the infrastructure for a cold chain facility is built up because the investment team has convinced the rest of the government to devote resources towards the project, then the boosted investment adds to their prestige and/or compensation. The investment team is the best set of people to push those policy changes, because not only do they know their own government well, but they are the ones who will have the best sense of what investors want.

In Rwanda, for example, the head of the Rwanda Development Board is a cabinet level official, and reports directly to the President of Rwanda. Singapore’s first Economic Development Board Chairman was Hon Sui Sen, a close associate of Singapore’s Finance Minister Goh Keng Swee and an accomplished civil servant in his own right. Likewise, the status of the investment team in the charter city might be able to convince other stakeholders to work with them.

Financing

The other important aspect of an investment team is its ability to facilitate access to financing for new projects quickly (and appropriate to the conditions of the project). In How Asia Works, Joe Studwell makes the case that while it is important to give subsidies to companies in nascent target industries, what makes the difference is whether they are conditional on export performance or not. As he says in an interview from 2013:

“When you have export discipline, the game changes. First, export discipline is almost inevitably bound up with a focus on manufacturing because manufactures are way more freely traded in the world than services (services are only 19% of world trade and have been stuck at that level for a quarter century). So entrepreneurs manufacture because manufactures are readily exportable.

Then comes the information bit. The capacity to export tells the state whether firms it subsidizes…are globally competitive. Domestic financial institutions benefit from the same information feedback. Of course you can sell at a loss for a while, but not long if you have to export, say, 30% of your output, because it will bankrupt your firm. As a result, the capacity of the entrepreneur to deceive the state is undermined. He or she faces the horrible reality that in order to feed their insatiable desire for wealth and recognition (those ‘animal spirits’) they have to knuckle down, actually make stuff, and sell it in the viciously competitive world market.”

The investment team of a charter city should use the same principle when giving subsidies and tax credits. Practically, this means that in the initial stages the firms that get funding from the charter city have to justify the money given to them by demonstrating high performance as fast as possible. This avoids the condition where firms get money from the city but then fail to perform economically. As Studwell explains, the only way it is possible for both the firms or the state to know if the money is being well spent is to require the firm to compete in the export market. This serves as a forcing function for innovation and competitiveness.

An important institutional arrangement is for the investment team to have the ability to give money out to firms without seeking excess bureaucratic approval every step of the way. Singapore’s Economic Development Board gets a pre-decided amount of money every year from the Ministry of Finance which it can lend out to companies (or provide tax breaks). This is much faster than the alternative where EDB is forced to get approval from the Finance Ministry for every loan it makes or tax break it gives. If speed is as important as this essay has previously stated, then getting money in the bank account of investors as fast as possible is extremely important.

Failure modes

There are a few ways that this idea could fail, or otherwise see limited success. One possible way is that the investment team might select the wrong industry, which leads to low growth over the long run. See the section “Industry Options” of the Charter Cities Institute’s Industrial Strategy Guide for more on this.

Coordination with the local government

The next plausible failure mode is that the charter city and the local government are unable to coordinate and produce policy solutions. The charter city by itself cannot change all local government policy or cannot build infrastructure outside its bounds. What matters here is its relationship with the local government, and the capacity of the charter city to adopt and their combined ability to implement new economic policies.

If any of the above problems exist, it means that the investment team is ineffective because it cannot recommend policy or coordinate it with the local government. The charter city’s capabilities stay static, as opposed to dynamic, over time in response to industry conditions and the city’s development needs.

How does the charter city avoid such a problem?

The first solution is to have controversial changes to be implemented within the charter city itself. A change that may be quite disruptive outside the charter city (like changing labor laws), should be ring fenced within the charter city itself. It is an easy way of avoiding potential conflict with the local government, while allowing growth for the charter city.

The next solution is to have the charter city itself implement certain policies. Perhaps it is outside the existing capability of the local government to implement something (like regulating a stock market). If this is crucial to the charter city’s development, it would make more sense for the charter city to execute it itself.

Case Study: Gu’an New Industry City

One problem with local governments trying to attract investment and develop cities themselves is that they may not have the knowledge and experience to do so. It takes one set of skills to run a local government and an entirely separate set of skills to develop a new one and attract investments for it. One solution to this problem utilized in China has been to give private developers authority over large swathes of land for multiple years to develop and administer (in certain policy domains), and in return, the local government gets a share of the rents and tax revenues generated from the area. The city of Gu’an transformed itself from the poorest county in Hebei Province to the richest in just 15 years via this method. The government offered a contract to China Fortune Land Development (CFLD), a real estate developer.

To quote Angie Jo’s thesis:

“CFLD offered the local government a total package of services in planning, building, and populating a new industrial city on 60 sq. km of vacant land, with an economic base driven by three high-tech sectors—advanced LED display manufacturing, aviation and aerospace technology, and biomedical R&D—which they proposed would generate sustained economic growth for the county over the long-term.”

The role of the Gu’an county government would be to approve projects, so long as they were within local government rules. CFLD would take care of the rest: attracting investments, planning, building, populating the city, and so on. CFLD would control the development of the city for a period of 50 years, get first rights access to the land, and split revenue with the local government.

How is this experiment going? Pretty well. Gu’an county tax revenues have jumped 90 times in 15 years. Per capita income was slightly under US$1,000 when the project started in 2002, rising to over US$7,000 by 2018.

The benefits enjoyed by the developer are obvious. While it invests a large amount of money, it generates substantial returns. The developer invested about US$5 billion to now get a city where total tax revenue is US$1.5 billion a year, total investments are US$22 billion, and production capacities are valued at US$14.6 billion. CFLD gets paid a service fee (15% of their expenses from the previous year), a fee for planning services (10% of the total cost to CFLD), the government pays CFLD 45% of the value of any fixed investments in Gu’an, and CFLD gets to keep ~40% of the total tax revenues.

CFLD actually made more money in all its projects from its investment attraction activities than it did from selling residential apartments. It made $1.6 billion from corporate solicitation (60% of gross profit), while revenue from selling residential units was only $800 million (30% of gross profit). CFLD’s main role here has not been just a real estate developer. It is a service provider whose primary client is the local government.

What has CLFD done that is special, in this case? Because it is a long-term owner of the land, its primary incentive is to increase the land’s value by making it more productive and providing valuable urban amenities and services. CFLD used its corporate networks to attract investment in high value industries: advanced display manufacturing, aerospace and aviation, and biomedical R&D, which have added over 30,000 jobs in the area. As an executive of another real estate firm said (p. 88):

“Right now in China, it has become very difficult to do a purely real estate business… real estate companies everywhere are now trying to convert their business from pure real estate to science and technology development. You must tell a good story to the government, you have to come equipped with success stories and achievements. The idea of the science park makes for a good story, which becomes good bargaining power with the government.”

What made Gu’an so successful?

Location

The site needs to be close enough to existing urban and industrial centers to be able to attract firms and workers willing to move there, but also far enough away to enjoy lower land prices. CFLD prefers sites about 50 to 80 kilometers from China’s industrial centers. Gu’an was 50km away from the Beijing-Tianjin belt, which made it an attractive location.

Industry Choice

The decisions around which industries to target are dependent on industry analysis done by specialists at CFLD. Its in-house research institute hosts over 5,000 people, of which 1,400 have masters degrees or higher. CFLD has better data sources than its competition (remote sensor data, satellite data, nighttime lights, cell phone usage, public transportation, flights, transactions, consumption, commuting times, demographic changes) and the company asserts that it is the only one with such a “systematic and scientific” process.

But in the end, the decision to target industries rests with the local government. They make this determination often with one key consideration in mind: does this industry fit with the policies announced by the central government in Beijing? CFLD makes this easier for them by suggesting sectors already in line with central government strategy, like Made in China 2025.

Timing

Finally, the last part developers like CFLD must consider is the timing of the project. Cities like these take years to develop, or even decades. Gu’an’s contract was signed in 2002, but companies only came in 2007. Zhengdong, China used to be a ghost town, but people and investments flew in fast. The main issue is that this intermediate period is very risky and the company must go without positive cashflow until investments come in. Only between five and ten years into the project, when housing begins selling, does the developer start making money.

In other words, a key risk in these new city projects is that things change over fifty years. Industries face disruption and government policies evolve. Only because CFLD was flexible, was it able to adapt to these changes. For example, there was a large soccer stadium planned to be the home of Hebei China Fortune FC, but this was scrapped. Another example of such flexibility and responsiveness to changing local conditions was when government policy was altered and the State Council approved a second international airport in Beijing just 12km away from Gu’an. This allowed CFLD to re-prioritize aviation industries more and so offices of several Chinese aviation and aerospace companies came to Gu’an.

Conclusion

Gu’an’s story has some important lessons for charter cities. Charter city operators can help improve the economy of cities when their incentives are aligned with the host government. More importantly, it also shows the value of a well targeted industrial strategy focused on sectors that lead to high productivity growth.

A sector-specific recommendation

One important change in firm behavior has been the shift towards supply chain resiliency, or so-called ‘reshoring’, as firms move their supply chains out of China and into other emerging economies like Vietnam, India, and Malaysia. Governments are encouraging firms to move their supply chains out of China (Japan provides monetary incentives) and to other locations with less political risk exposure and less concentration in potentially hostile countries.

These supply chain adjustments provide an opportunity for charter cities to expand manufacturing and eventually move up these shifting supply chains. One important product undergoing this turbulence is solar panels. Solar energy costs have dropped over 90% in the last 10 years, making the technology cheaper than many coal projects. Along with expanding energy demand, solar energy capacity in emerging markets (like India) and increasing hostilities with China means that there will be a place for a producer of solar energy panels to make them cheaper and gain market share. The International Energy Agency expects (page 10) over $120 billion of solar energy investment in manufacturing before 2030. This, coupled with solar energy demand, and the diversification of supply chains, would lead to an opportunity for a charter city to gain a foothold in the market.

Other strategic supply chains undergoing significant shifts include semiconductors and critical minerals, among others. Charter City investment teams should be continually on the lookout for such opportunities.

What determines success or failure?

In the solar panel example, one important part is the price of electricity: electricity accounts for over 40% of the cost of manufacturing polysilicon and over 20% for ingots and wafers (all of which are components of making PV modules). One of China’s key advantages in this has been that its electricity production costs are US$75/MWh, which is 30% lower than those in other countries. Charter cities could get an advantage in this by providing cheap electricity to firms for a limited period of time until they get a cost advantage over competing firms

Second, there are significant economies of scale in building solar panels. Costs for larger projects are lower per megawatt than those for smaller ones. This is one of the main reasons for China’s cost advantage in the solar PV system: it has projects ranging from 5 to 20 GW a year while those elsewhere are a fifth of that size.

Finally, for the charter city itself, there are multiple benefits from solar manufacturing. The first is jobs. The number of people required per megawatt hour varies from 50 and 400 depending on the part of the supply chain. The second is that being part of the higher end of the solar panel supply chain (mainly polysilicon manufacturing) can be an entry point into semiconductor manufacturing which is higher productivity than solar panel manufacturing. Another benefit is that when it comes to megaprojects, solar projects actually fare very well when it comes to things like cost overruns and time overruns, outperforming other types of megaprojects like nuclear, hydroelectric, and ICT projects.

What can government and charter city investment teams do for solar PV manufacturing? The main objective is to get the basic infrastructure for solar PV manufacturing in order, so companies that invest have a competitive advantage in cost relative to other countries. This includes low cost electricity and land so both the initial investment cost and continuing manufacturing costs are lower than rivals. It would also be important to have large amounts of land set aside for this to have lower costs due to economies of scale.

The charter city can then move up the supply chain to higher end manufacturing, and perhaps out of solar PVs altogether.

One example of this is in Costa Rica, where the government, along with semiconductor producer Intel, worked to move the country’s industry higher up in the semiconductor supply chain by upskilling their workforce. As this research report from the ILO states:

“Beginning in the 1980s and deepening into the 1990s, Costa Rica understood that continuing to compete based on low value-added production lines and low-skilled sectors such as textile and apparel or continuing to rely on a few primary products such as coffee, bananas, and sugar, was not a winning strategy

Starting in the mid-1980s, and with greater focus and clarity in the 1990s, the country set out to insert itself into new value chains through selective policies to attract investment and promote non-traditional exports. Intel’s decision to open a microprocessor assembly and test plant in the country, which was a result of investment attraction efforts and Intel’s corporate strategy, was a turning point.”

Costa Rica’s investment agency CINDE had been attracting investments in an attempt to move away from its low skill industrial base, and Intel was among the companies that was part of it. They put a large amount of effort into it, with even the President of Costa Rica getting involved in the process of attracting their investment and reducing the red tape that was required to enter the country.

“The President, in conjunction with relevant public institutions, established a special mechanism to accelerate the process. The mechanism was one “in which a liaison was designated to coordinate the process with all of the government institutions involved and, most importantly, to produce answers quickly to any questions that arose. The president’s intervention and the characteristics of those in charge of this process were key factors that ensured that this mechanism worked effectively.” (ILO, 1997, p. 16). As a result of these efforts, on November 13, 1996 Intel announced its decision to construct its new assembly and test site in Costa Rica.”

The effects of this have been unambiguously positive. Intel has contributed to between 0.3 and 1% of Costa Rica’s GDP growth every year. Despite Intel shifting operations to Asia, the company still employs over 2,000 people in the country. Intel pays a salary six times that of the average manufacturing wage.